While many aspects of a will may remain the same as you go through life, some things may change, prompting you to make changes. Rather than totally rewriting a will, some people opt to write a codicil. A codicil is an amendment to an existing will. [1] Although it may be wiser to rewrite your entire will, a codicil may be a faster and more cost-effective alternative.

Steps Edit

Part One of Two:

Writing Your Codicil Edit

Read your original will. Make sure that the copy that you have is the final version of your last will and testament. Also gather any other existing codicils to your will. Then, identify the problems existing in the will and make note of them.

- Common reasons why people decide to make an amendment to a will include: [2]

- executor of the will has passed or is no longer desirable.

- beneficiaries need to be changed or others need to be added.

- special needs of your family have changed – for instance, the guardian(s) of minor children have passed or must be replaced.

- financial circumstances – assets and liabilities – of your life have changed.

- funeral and burial arrangements have changed.

- there are significant tax consequences that are not covered by our will that must be addressed to protect the beneficiaries.

Can you please put wikiHow on the whitelist for your ad blocker? wikiHow relies on ad money to give you our free how-to guides. Learn how .

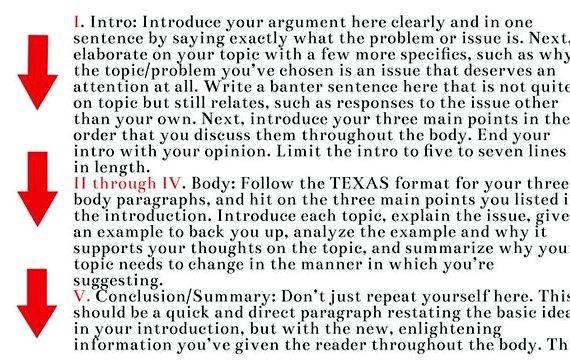

Title the document. Before you begin writing your codicil, you will need to give it an appropriate title to indicate the document’s purpose. An appropriate title for a codicil would be: Codicil to the Last Will and Testament of [your full name]. [3]

Write the opening paragraph. The first paragraph of the document should state: [4]

- “I [your name], [your address – including the city, county and state in which you live], being of sound mind, declare that this Codicil to the Last Will and Testament of [your name] is effective on this date and shall hereby amend my Last Will and Testament dated [insert date of will] as follows:”

- Include the date of your original will in your codicil. Including this date will show that you are aware of the original document and help prevent those who interpret your will from thinking that you may have created this document without knowledge of the original will. [5]

Identify the article that you would like to amend, delete, or add to your will. Make sure that you specify the article number and state in detail what the changes will be. [6]

- If you want to amend something, you could write: “Article 1 shall be amended to state [State your present and foreseen needs and desires that need to be changed – for example, changing the name(s) of beneficiary(ies) and/or the executor of the will.]”

- If you want to delete an article, you could write: “Article 1 shall be deleted in its entirety.”

- If you want to add an article, you could write: “Article 8 is hereby added as follows: [Include additional directives that were not included in your original will – for example, adding a provision that will afford your estate the optimum tax consequences upon your death.]”

Acknowledge that your codicil will overrule anything in your original will that contradicts it. To accomplish this, you could write: “If any statement in this Codicil to the Last Will and Testament of [your full name] contradicts my Last Will and Testament dated [insert date of will], this Codicil shall control.” [7]

Reaffirm your will. You should write, “In all other respects I reaffirm and republish my will dated [insert the date of the will.]” [8]

Use a professional legal tone throughout your codicil. Use the same style and structure in your codicil that you used in your original will. Keeping with the same style will help your codicil to match up with your will and reduce any potential confusion.

- If you used an attorney for the original will, consider hiring the same attorney to draft the codicil. This will assure consistency.

- Likewise, if you used specific software to draft your will, consider using the same software to draft your codicil.

Be specific about the changes you want to make. For example, if you want to change appointed guardians for beneficiaries, change funeral arrangements, or reallocate some of your assets in the event of your passing, say so using direct, clear terms.

Proofread your codicil. To make certain that you have written your codicil in a way that cannot be mistaken by others, ask someone you trust to read it. If you are not comfortable with writing in a professional legal tone or you have concerns about grammar, you should also have someone who is skilled in these areas proofread your codicil.

- You might also consider having an attorney read over your codicil. In that case, you will need to provide the attorney with a copy of your existing will as well.

Execute the codicil. You should execute the codicil in the same manner as the will. [9] Sign your will in the presence of two witnesses.

- If you are satisfied that the codicil to your last will and testament expresses your desires and needs to meet your post-death wishes, make certain that you sign the codicil in the presence of competent witnesses who have no personal or financial interest in your will.

- If your state requires three witnesses to execute a will, then use three for the codicil.

Include a self-executing affidavit. An affidavit will greatly speed up the probate process. To execute the affidavit, sign the will in front of the notary and get the will notarized. Append the following language to the end of the will:

- “I, [insert name], declare to the officer taking my acknowledgement of this instrument, and to the subscribing witnesses, that I signed this instrument as my codicil.” [10] Then sign your name beneath this language.

- Insert the following language for the witnesses. “We, [insert name] and [insert name], have been sworn by the officer signing below, and declare to that officer on our oaths that the testator declared the instrument to be the testator’s codicil and signed it in our presence, and that we each signed the instrument as witnesses in the presence of the testator and of each other.” [11] Then have the two witnesses sign beneath this.

- Then include this language for the notary: “Acknowledged and subscribed before me by the testator, [type or print the testator’s name], who is personally known to me or who has produced [state the identification], and sworn to and subscribed before me by the witnesses, [print or type name of first witness], who is personally known to me or who has produced [state the identification produced] as identification, and [type or print name of second witness], who is personally known to me or who has produced [state type of identification produced] as identification, and subscribed by me in the presence of the testator and the subscribing witnesses, all on [insert the date].” [12] Then have the notary sign and affix official stamp or seal.

Store your codicil with your last will and testament. To ensure the safety of your codicil, you should keep it in the same place as your will. For example, if your original will is kept in the attorney’s office, then it makes good sense to keep any codicils there as well. [13]

Will I have to pay taxes on money I inherited?

Answered by wikiHow Contributor

- There are two types of taxes, Estate Taxes (paid by the estate) and Inheritance Taxes (owed by the recipient or “beneficiary”). As of 2016, there is a Federal Estate and Gift tax exemption of $5.45 million (plus other exclusions like transfers to spouses) before Estate taxes are due. Other than that there is no Federal Inheritance tax payable by the beneficiary. Most states don’t assess Estate or Inheritance taxes, but you’ll have to check.

What documents do I in need to file to change the executor of a family trust?

Answered by wikiHow Contributor

- As the grantor, you’ll typically need to draft and file a restatement to modify a trust and change the executor. As a beneficiary, you’ll need to file a petition to change the trustee with the court. For more information, read our article on How to Change the Executor of a Family Trust .

I want to delete the beneficiary of my residual estate and name a new one. Is this deletion and addition a change I can make by a codicil?

Answered by wikiHow Contributor

- Yes. You can use a codicil to make the changes to your existing will, and this codicil needs to be witnessed and notarized so it’s legal. If you search Rocket Lawyer in your web browser, this website will walk you through the process and provide you a checklist for all the forms/signatures/notary etc that you need.

Writing hypothesis middle school science

Writing hypothesis middle school science Pursuing your passion for writing

Pursuing your passion for writing Pearson my canadian writing lab

Pearson my canadian writing lab Writing a bio for yourself for court

Writing a bio for yourself for court Le mystere de la maison grise summary writing

Le mystere de la maison grise summary writing