Five ways to protect your growing family

As a parent, you now have someone depending on you who you need to protect and provide for.

The last thing you want to think about is how your family would cope financially if something went wrong with your or your partner’s health or job. But being prepared for the unexpected means peace

of mind and it needn’t be overwhelming. Here are some steps you can take to ensure that should

your family lose one income for a period of time, you can be safe in the knowledge that they will be

able to manage.

Life assurance

Although the death of a partner is not something that most people like to dwell on, it is important to be prepared for the eventuality. Life assurance where the insurer promises to pay money to a beneficiary upon the death of the insured person is the simplest type of life protection policy available. The payout should aim to pay off any outstanding debt and ensure your family is financially provided for. This type of policy has a specific level of cover, known as the ‘sum assured’, which is chosen to suit your own needs. A rough rule of thumb for either parent is 10 times the highest earner’s income, or the most you can afford up to that amount. You decide how long you need the protection for and this is known as ‘the term’. If you die during the term of a policy, the sum assured is paid, normally tax-free.

‘Level term assurance’ is one of the most popular types of life insurance with families in the UK because it is affordable and easy to understand. The premiums are constant throughout the specified term, which you can choose yourself.

Couples can go for either separate policies or a joint one if there is a shared obligation such as a mortgage, although be aware that a joint policy is only suitable if you need to pay out the same amount for both partners. It’s important to note also that joint policies usually cease if either policyholder dies, leaving the survivor with no cover.

The average cost of raising a child from birth to the age of 21 is estimated to be £210,000, which has climbed over 40% in the last decade

Income protection

Income protection is an insurance policy that provides you with a regular tax-free income, should you become too ill to work. The benefit paid is up to a maximum percentage of your earnings often 50% or 60%. The policy pays out after you’ve been off work for a specified period known as the ‘deferred period’, and will continue to pay out until you can get back to work or you retire, or until the end of the policy term if that is earlier. With some policies you can choose a deferred period of 4, 13, 26 or 52 weeks, depending on how long you may be able to survive on any savings or how long you receive sick pay from your employer. The longer the deferred period, the lower the cost. Premiums can vary hugely based on your gender, occupation, whether you smoke and the level of cover you need.

Critical illness cover

This type of cover usually pays as a protection against one or more illnesses, diseases or conditions specified in the policy terms.

It is often taken out alongside a life insurance plan and is generally used to cover capital need. You insure a fixed sum at the outset for example the outstanding balance on your mortgage and this is paid out on the diagnosis of one of the 30 or so conditions listed on the policy. Be aware that the list may be limited and there are often caveats about the severity of the condition and its prognosis. You should also ensure that you make known any past conditions to avoid non-disclosure issues.

Mortgage protection

This is a type of term insurance designed to protect your home in the event of your death or critical illness, so your family doesn’t have to worry about having to meet mortgage repayments. The level

of cover is set to match the original mortgage amount and reduces over the years as you repay your mortgage. It is also sometimes known as a ‘decreasing term assurance policy’, and usually guarantees to pay off the outstanding mortgage, assuming that it is taken out at the same time

as the mortgage and that the mortgage interest rate payable does not go above a certain rate. It is usually considerably cheaper than ordinary term assurance, but doesn’t cover other elements of your family’s expenditure.

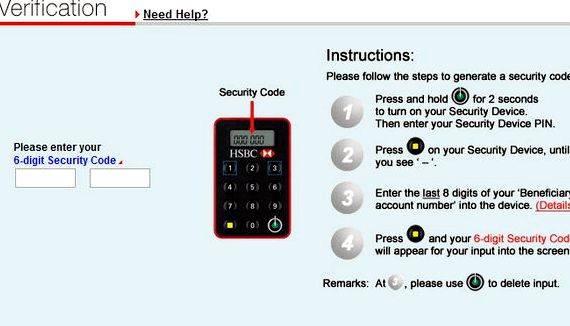

You may find it cheaper and easier to opt for a more inclusive policy that combines different types of cover. HSBC LifeChoices allows you to build your own protection package according to your needs, including life, critical illness and income protection .

Although there is no legal requirement to do so, making a will is the best way to ensure that after you die, your properties and possessions are passed on exactly as you wish. If you die without a will, your assets may be distributed according to the laws of intestacy. The cost of writing a will can vary and depends on how complicated your affairs may be. Although it’s possible to write a will by yourself, using a solicitor or specialist will writing service is recommended. Consulting a specialist will mean that you don’t overlook any of the legal formalities you need to follow to make sure your will is valid.

It’s important to choose an executor who will be responsible for your estate often your spouse and an additional executor in case something happens to them. Specify a guardian for your children. If you are the last living parent and your children are under 18, a guardian will be appointed by the court unless you have specified who their guardian will be.

Sign your will in front of two independent witnesses who are not beneficiaries and store it in a

proper, safe storage facility. If you use a will writing service, it is likely that your executors will

receive a certificate telling them where to find it. If you make your own will, you should inform your executors yourself.

For more information on making wills and on inheritance tax, visit the HM Revenue Customs website .

Most health services are free through the NHS, but there can be charges for some things, and it’s important to make sure your family can cover any additional costs. Treatment is free at certain walk-in centres when they are treating an emergency, but may not be in non-emergency circumstances. Treatment for certain infectious diseases is free, as is family planning and compulsory psychiatric treatment. If your child is under the age of 18 or under 19 and in full-time education, they are entitled to free dental treatment. Those under the age of 16 or under 19 and in full-time education are entitled to help with the cost of prescription lenses or glasses, and free sight tests. Prescriptions are free in Scotland and Wales. In England, you may be entitled to free prescriptions depending on your circumstances for example, if you’re on Income Support or Jobseeker’s Allowance, are over the age of 60, are pregnant or have had a baby in the past 12 months. You can check which services you and your family are entitled to for free by visiting the NHS website .

Or you can opt for private healthcare, which may give you access to quicker treatment than the NHS. This, however, comes at a cost and private health insurance policies may contain coverage limitations.

The average cost of raising a child from birth to the age of 21 is estimated to be £210,000, which has climbed over 40% in the last decade, according to research by the insurer LV. It’s natural for every parent to want the best opportunities for their child, but with the Government announcing that child trust funds are to be scrapped for all children born after January 2011, many are wondering how to save for their children’s long-term future. The free HSBC Children’s Future Planner tool helps you calculate the cost of the goals you set for your children.

Childcare and education account for the biggest proportion of the cost of raising a child. After September 2012, ministers have decided that the standard level for tuition fees will be £6,000, up from the current level of £3,290, but universities will be able to charge up to £9,000 if they fulfil certain conditions. This does not include living costs and you should bear in mind that these will be steeper in more expensive places like inner cities.

Cash ISAs are a great way to save in the long term as they allow you to use your annual tax-free savings allowance and build up your savings year after year. If you use up your tax-free allowance and you’re prepared to lock your money away for a period of time, you may find a fixed-term savings account provides a higher rate of interest. Read about our Cash ISAs and other savings products available

from HSBC.

As well as locking money away for your child’s future, it’s sensible to have some instant access savings accounts. So if there is an unexpected event such as an emergency or you simply want some cash for a rainy day, you can make a withdrawal without giving notice. Read about our Online Bonus Saver, Flexible Saver, Premier Savings and other savings products available from HSBC.

It’s also a good idea to teach your child money-management skills from a young age. Giving them regular pocket money and putting cash from birthdays and Christmas into a savings account can encourage a saving habit. When statements arrive, you might want to go through them together and explain what any numbers mean. You could encourage them to choose one spending goal, whether it’s a toy, a pair of trainers, a new bike, or something relatively inexpensive. Your child will be able to see clearly how their money slowly accumulates, and then experience a sense of reward when they can afford to buy the chosen item.

Best cv writing service uk reviews

Best cv writing service uk reviews Resume writing service in san jose

Resume writing service in san jose Thesis writing service philippines medal wwii

Thesis writing service philippines medal wwii Cheapest essay writing service uk samsung

Cheapest essay writing service uk samsung Best dissertation writing service uk review ea

Best dissertation writing service uk review ea