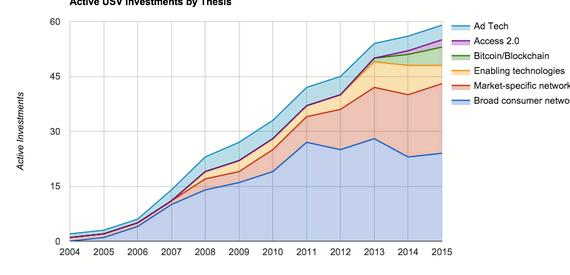

Because the venture business is continuing to grow and matured, many firms allow us specific regions of focus. Our firm, Union Square Ventures. for instance only invests in web services. In my opinion this is an excellent factor for the investors in venture funds, known as LPs, and also the entrepreneurs.

But there are a variety of the way that firms can execute their concentrate on a specific area. Two of the largest are thematic investing and thesis driven investing.

They are not the same.

Thematic investing involves identifying big styles on and on after them. Examples from the field of web services could be social media, movie, ad systems, social networking, real-time, mobile. I understand many VCs who do it by doing this. They find out the styles after which outside, hurry up completing their portfolio with firms that fit individuals styles.

Thesis driven investing involves drawing an image of where your unique section of focus goes. I love to have a 5 to 10 year view. And after you have mapped out that picture, it might be your thesis. And also you evaluate every investment you are making poor that thesis.

The 2 venture firms I’ve tried founding are great examples of the approaches. Flatiron Partners was largely a thematic oriented firm. We identified the net like a big theme and there we identified content, commerce, and community. So we made big bets in individuals styles. It labored out pretty much but we didn’t begin to see the web altering in the finish from the decade around we ought to have.

Union Square Ventures is really a thesis driven firm. I owe that to my founding partner, Kaira Burnham.

that has the discipline to pressure everybody to complete the job to build up our thesis and also the discipline to make certain we put every single investment with the thesis test.

Just a week ago, i was meeting and among our LPs and that i was speaking concerning the mobile web for the reason that meeting. Later that mid-day, Kaira walked into my office and set our thesis on web versus mobile web up for grabs so we ensured i was seeing the mobile sector engage in exactly the same way. A key point in thesis driven investing is everybody within the firm must subscribe to the thesis or it won’t work.

Thematic investing will work for bigger firms. It enables each partner to choose a few styles and pursue them. Thesis driven investing will work for smaller sized firms. It takes a good team that actually works to help keep themselves on a single page executing following a singular vision.

In my opinion thesis driven investing creates the best returns once the thesis is directionally correct and most likely even the worst returns once the thesis is wrong. In my opinion thematic investing works less mainly because it can result in bucket filling in which the firm just moment filling the styles with deals with little considered to why and just how they are effective. Additionally, it leads to numerous me too investing that is a scourge the venture industry can’t appear to learn how to rid itself of.

But both thematic investing and thesis driven investing are superior to a generalist approach simply because they both promote domain expertise that is important to creating a sustainable investment advantage.

I believe generalist or opportunistic investing will probably underperform domain expert driven purchasing basically probably the most turbulent markets.

It might be best to talk much more about how one goes about creating a 5 to 10 year map of where a business is headed. That’s an extended conversation than I’ve here we are at today. However I’ll give you the idea this blog is part of the way i build mine.

Defended her phd thesis proposal

Defended her phd thesis proposal College pressures by william zinsser thesis writing

College pressures by william zinsser thesis writing Thesis writing references for a research

Thesis writing references for a research Translation studies phd thesis writing

Translation studies phd thesis writing Digital thesis and dissertation online

Digital thesis and dissertation online