We’re conntacting you within our capacity as Samsung Electronics’ (OTC:SSNLF ) shareholders, to place forward the restructuring, capital return, investor access and governance improvement proposals for Samsung Electronics that are outlined during this letter along with the enclosed presentation (the “Samsung Electronics Value Enhancement Proposals “). The proposals are really designed particularly to handle problems outlined during this letter, which we percieve as getting depressed shareholder value at Samsung Electronics after a while.

Samsung Electronics does a outstanding job of creating an initial-class portfolio of businesses that have Korea’s flagship enterprise using among the earth’s most important technology companies. Regardless of the recent unfortunate occasions connected with battery cells for the World Note 7, Samsung Electronics is well-positioned in relation to business and profitability. Its strengths inside the core semiconductor, mobile, display and electronics publication rack respected by consumers and investors around the globe. The founding family and charge of Samsung Electronics particularly needs to be applauded of individuals achievements.

Concurrently, however, Samsung Electronics’ shareholders have endured inside the extended-term undervaluation in the industry using the equity market. Samsung Electronics’ ordinary shares are exchanging at roughly 6 occasions expected one-year forward earnings ex-cash, well underneath the valuations that have been consistently achieved getting a gift basket of comparable peers of 11 occasions expected one-year forward earnings ex-cash, as detailed within the enclosed presentation, plus contrast for that 11 occasions earnings prices within the KOSPI6 round the one-year forward basis.

To put it simply, the outstanding achievements of Samsung Electronics were not correctly reflected within the market’s valuation from the shares, which problem ought to be addressed.

Everyone knows about various public reviews, including individuals of countless worldwide investment banks, on the plethora of streamlining the Samsung group. Our purpose in publishing the Samsung Electronics Value Enhancement Proposals should be to allow their full and proper evaluation by all concerned. We are feeling that, if effected, they’d bring significant and sustainable advantages of all Samsung Electronics’ shareholders (retail, institutional, domestic and worldwide), furthermore to Samsung Electronics’ management along with other stakeholders.

We percieve this as being a defining moment along with a tremendous chance for your forthcoming new leadership of Samsung Electronics to help advance their outstanding legacy. The time has come legitimate shareholder value, corporate governance and transparency enhancements, which we are feeling may help Samsung Electronics achieve an equity market valuation that correctly reflects its first-class portfolio of companies. Hopefully you’ll seize this chance.

The Samsung Electronics Value Enhancement Proposals

Rationale – addressing key value-sapping issues

Within our assessment, the Samsung Electronics Value Enhancement Proposals provides you with better capital returns, better corporate governance, which has been enhanced shareholder value, for people Samsung Electronics’ shareholders – although simplifying, and retaining the founding family’s controlling curiosity about our Samsung group corporate structure, for the advantage of all stakeholders.

Unnecessarily complex Samsung group structure and continuing uncertainty around a potential restructuring

The Samsung group structure is at our ideas unnecessarily complex, including due to the different legacy treasury, circular and blend-shareholdings. Ongoing uncertainty around a potential broader group restructuring isn’t useful.

We are feeling the right resolution to the present uncertainty surrounding a potential restructuring of Samsung Electronics that is affiliates is required. We anticipate apparent sustainable benefits for people Samsung Electronics’ stakeholders of unlocking the requirement of Samsung Electronics’ significant treasury shareholding and developing a effective and stable corporate structure for the Samsung group, the Samsung Electronics Value Enhancement Proposals are produced to attain.

Sub-optimal capital management and bottom-tier shareholder returns at Samsung Electronics

Samsung Electronics is presently considerably overcapitalized that is treasury shareholding happens on its balance sheet at cost. We encounter Samsung Electronics management’s recent capital return efforts using the KRW11.4 trillion share buyback program (that repurchased shares were or needs to be cancelled) as useful and well-received using the market. However, we feel that people efforts have clearly not been sufficient to cope with Samsung Electronics’ excessive and inefficient capital structure – along with a cash balance which have grown to KRW77 trillion by June 30, 2016, combined with remaining treasury shareholding.

Because the enclosed presentation illustrates, we are feeling the resulting balance sheet inefficiencies have depressed Samsung Electronics’ returns on equity, which, relatively speaking, are really among the least costly within the sector for just about any extended time. This is also true of dividend yields and dividend payout ratios.

We percieve no justification for the business remaining so overcapitalized. The present cash reserves far exceed the versatility required for future investment options as well as for Samsung Electronics to keep and enhance its position as being a leading global business. This is also true taking into consideration the ongoing robust free earnings generation levels at Samsung Electronics. In relation to existing Samsung Electronics’ treasury shareholding, if the requirement of that isn’t unlocked incorporated inside the group streamlining we’re proposing, your recent policy of cancelling repurchased Samsung Electronics shares must be put overall treasury shareholding, it’s ignore a substantial continue shareholder value.

Getting less a effective worldwide equity listing for Samsung Electronics’ core operating companies

Samsung Electronics presently lacks a effective worldwide equity listing (furthermore towards the KRX listing) because of its core operating companies, regardless of the impressive scale and global achieve of individuals companies. We are feeling that having less this type of worldwide listing and related insufficient market liquidity has hindered investor access and held back Samsung Electronics’ equity market cost.

Subpar corporate governance inside the Samsung group

Regardless of the Samsung group’s achievements in building world-class companies, we are in good company in observing the implementation of guidelines in corporate governance hasn’t adopted suit. For instance, last year’s hotly-disputed merger between Samsung CT Corporation and Cheil Industries Corporation. brought to calls business market participants for significant governance enhancements inside the Samsung group.

We are feeling that Samsung Electronics’ stakeholders would benefit greatly from corporate governance enhancements, including, as being a beginning point, the adoption in the board structure consistent with Samsung Electronics’ standing as being a leading global business.

Key components and particular benefits

The Samsung Electronics Value Enhancement Proposals, which should address these issues, would entail certain key components being implemented by Samsung Electronics that is affiliates round the consensual basis:

Samsung group restructuring

- Doing the work to unlock the requirement of Samsung Electronics’ treasury shareholding, incorporated in the streamlining within the Samsung group structure by –

- demerging Samsung Electronics (the “Demerger “) in a listed holding company (“Samsung Holdco “) along with a individually listed operating company (“Samsung Opco “)

- utilizing Samsung Holdco’s treasury shareholding to boost its getting Samsung Opco, employing a publish-listing tender offer produced by Samsung Holdco to everyone other Samsung Opco shareholders, to get part of the issued share capital of Samsung Opco, to obtain Samsung Holdco treasury shares (the “Tender Offer “) and

- effecting a share for share merger, on fair terms, of Samsung Holdco and Samsung CT Corporation (KRX stock code 028260:KS) (“SCT “) with SCIts the obtaining/surviving company (the “Samsung Holdco Merger “), to own further benefits for stakeholders in relation to group rationalization and control.

The Demerger, coupled with Tender Offer along with the Samsung Holdco Merger, would inside our opinion certainly be a capital gains tax efficient method of simplifying the dwelling of and control of the Samsung group and unlocking the requirement of Samsung Electronics’ treasury shareholding.

Special cash dividend which has been enhanced ongoing returns of capital at Samsung Opco

- Effecting a pace difference in Samsung Electronics’ capital management and shareholder returns, obtaining a Samsung Opco special cash dividend of KRW30 trillion or KRW245,000 per ordinary share (a considerable return useful to shareholders, building across the 2016 Samsung Buyback), along with an ongoing commitment, consistent with worldwide corporate standards, to come back 75% of Samsung Opco’s free earnings for the shareholders.

NASDAQ listing for Samsung Opco (in addition having a KRX listing)

- Growing investor understanding of and convenience Samsung group, including by means of Samsung Electronics creating a persistence because of its shareholders to discover a NASDAQ listing for Samsung Opco (in addition for the KRX listing). We are feeling that this sort of listing is extended past due taking into consideration the dimensions and global achieve within the Samsung Electronics operating companies, would facilitate additional worldwide investor access, and would support further sustainable shareholder value creation.

Board enhancements at Samsung Holdco and Samsung Opco

- Making extended-lasting enhancements to corporate governance plans at Samsung Electronics, including using the boards of company company company directors of Samsung Holdco and Samsung Opco increasingly more connected utilizing their particular shareholder bases. Particularly, we are feeling the addition for every board getting no less than three independent company company company directors with appropriate worldwide corporate backgrounds, additionally for you to get a view to enhancing diversity across the board incorporated inside the changes, may be of real value to everyone stakeholders.

We realize that once these key enhancements are really made there might be scope for further possession separation or minimization as relating to the financial sector and industrial sector Samsung group companies, under two separate listed holding companies. This can be while using the ongoing regulatory pressures on groups like Samsung to discover financial capital from industrial capital and to improve transparency, including by reduction of any residual circular holdings or mix-holdings within the group.

Independent research analysts have commented on a lot of the issues which underpin the Samsung Electronics Value Enhancement Proposals:

– “The quantity of FCF should still rise next few years, regardless of rising capex. Consequently, we predict share repurchases/cancellations to recur each year, in addition to rising cash dividends. Additionally, the company must implement another round from the ‘special’ share buyback program later on, since its internet cash balance remains rising, up 6%QoQ to Won64.9tr in 2Q16. ” – Macquarie, This summer time time 28, 2016

– “A way of unlocking this value generally is a holding and operating company separation. Advantages could include: (i) streamlining management structure focused on its business prospects and fewer group issues (ii) allowing greater transparency and potentially greater dividend payments to understand the holding company and (iii) this might involve potential gains from non-core asset disposals and revaluation of assets.” – Morgan Stanley, This summer time time 2, 2016

– “However, given very modest or even negative market expectations, we percieve significant rerating upside potential once the organization implements better shareholder returns, either proactively or pressed by minority shareholders.” -Citi, October 27, 2015

– “We are feeling SEC’s significant non-operating asset value should become apparent through positive shareholder returns along with the group restructuring process.” – Barclays, October 7, 2015

– “We are feeling market is giving a sizable discount to the requirement of its cash and investment assets which consider 44% in the present market cap because of poor capital management. Once group restructuring is close to the finish, however, we’re feeling SEC will progressively increase shareholder returns via share buybacks and greater dividends, that will provide significant catalysts for that stock, inside our opinion.Inch – JP Morgan, June 15, 2015

– “While using the recently produced incentive to take a position really it earnings through dividends, all investors in SEOC [newco] would benefit. We’re feeling, broadly rising dividend yield and valuation multiple discount on SEC’s shares (insufficient transparency, mix-holding structure, insufficient speed in creating a regular dividend policy and bloated equity base because of heavy cash accumulation) might be eliminated and a tone having a valuation multiple expansion. ” – Credit Suisse, The month from the month of the month of january 12, 2015

– “If Samsung Group would restructure in a holding company, our situation research has proven it might be susceptible to have positive share cost implications. LG Group’s value publish restructuring (having a holdco) elevated by 38.5% within the first six a few days, while SK Group’s value elevated 34% immediately after re-listing as being a holdco.” – Deutsche Bank, November 3, 2014

We urge the two of you, in conjuction with the position as company company company directors of Samsung Electronics, to check out the Samsung Electronics Value Enhancement Proposals within the light in the very real and measurable benefits which we are feeling they might have for Samsung Electronics’ stakeholders. We predict the entire and open review of the Samsung Electronics Value Enhancement Proposals may be welcomed having a massive nearly all Samsung Electronics’ shareholders.

Hopefully and think that these proposals might make an chance for your Samsung group to provide a effective signal for that market regarding its readiness to hear shareholder concerns. The advantages of this sort of signal may be far-reaching, helping produce the Samsung group the shareholder support it must achieve any significant extended-term restructuring goals, although showing real resolve to handle imbalance as between Samsung Electronics’ outstanding business performance that is share cost. Such leadership with the organization company company directors would truly mark a totally new, much more effective chapter, for the Samsung group.

Editor’s Note: This information discusses numerous securities that don’t trade round the major U.S. exchange. Take note of risks associated with such stocks.

Article writing on nature conservation

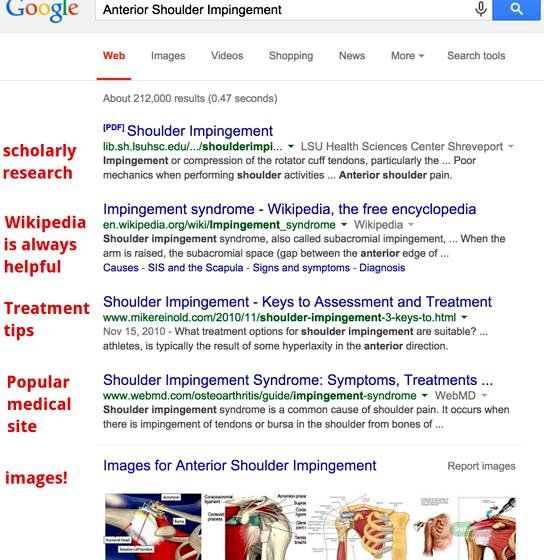

Article writing on nature conservation Ordonnance article 38 dissertation writing

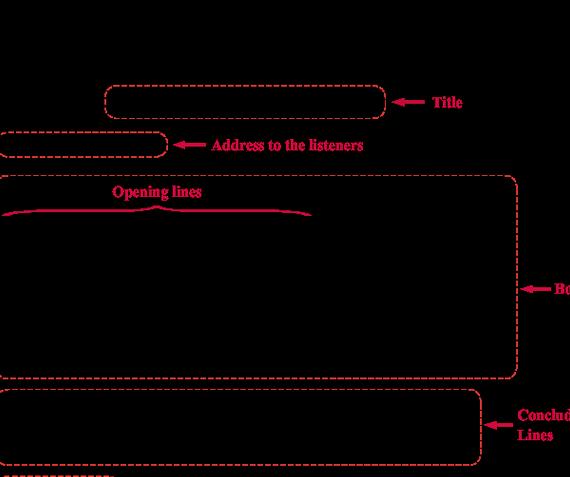

Ordonnance article 38 dissertation writing Writing journal articles ppt presentation

Writing journal articles ppt presentation Writing articles in third person

Writing articles in third person Make money writing travel articles online

Make money writing travel articles online