For tax purposes, a home improvement includes any work done that substantially adds to the value of your home, increases its useful life, or adapts it to new uses. These include room additions, new bathrooms, decks, fencing, landscaping, wiring upgrades, walkways, driveway, kitchen upgrades, plumbing upgrades, and new roofs.

If you use your home purely as your personal residence, you cannot deduct the cost of home improvements. These costs are nondeductible personal expenses.

However, this doesn’t mean that home improvements do not have a tax benefit. They can help reduce the amount of taxes you have to pay when you sell your home at a profit. This is because the cost of home improvements are added to the tax basis of your home. “Basis” means the amount of your investment in your home for tax purposes. The greater your basis, the less profit you’ll receive when you sell your home.

Jane purchased her home for $500,000 and sold it 25 years later for $900,000. During the time she owned her home, she made $50,000 worth of improvements, including a new bathroom and kitchen. These increased her basis to $550,000. She subtracts her $550,000 basis from the $900,000 sales price to determine her gain from the sale–$350,000. Only this amount is subject to tax (if Jane qualifies for the home sale tax exclusion, she need not pay tax on $250,000 of this amount).

Home improvements are the most common way homeowners increase their basis. However, your home’s basis does not include the cost of improvements that were later removed from the home. For example, if you installed a new chain-link fence 15 years ago and then replaced it with a redwood fence, the cost of the old fence is no longer part of your home’s basis.

Although you can’t deduct home improvements, it is possible to depreciate them. This means that you deduct the cost over several years–anywhere from three to 27.5 years. To qualify to depreciate home improvement costs, you must use a portion of your home other than as a personal residence.

You Qualify for the Home Office Deduction

One way you can depreciate home improvement costs is to have a business and use a portion of the home as an office for the business. To qualify for the home office deduction you must have a legitimate business and use part of your home exclusively and regularly for the business.

If you qualify for this deduction, you can deduct 100% of the cost of improvements you make just to your home office. For example, if you use a bedroom in your home as a home office and pay a carpenter to install built-in bookshelves, you may depreciate the entire cost as a business expense.

Improvements that benefit your entire home are depreciable according to the percentage of home office use. For example, if you use 20% of your home as an office, you may depreciate 20% of the cost to upgrade your home heating and air conditioning system.

You Rent Out Part of Your Home

Another way to depreciate home improvement costs is to rent out a portion of your home. This enables you to depreciate the expense as a rental expense. This amount is deducted from the rental income you receive.

As with the home office deduction, improvements that benefit only the portion of the home being rented can be depreciated in full.

Improvements that benefit the entire home can be depreciated according to the percentage of rental use of the home.

Learn more about your options to save on taxes in Nolo’s section on Homeowners Tax Deductions and Tax Credits .

Mystery writing prompts students international

Mystery writing prompts students international My writing desk schreibtisch ikea

My writing desk schreibtisch ikea Romulus my father summary writing

Romulus my father summary writing Workcover domestic assistance guidelines for writing

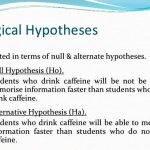

Workcover domestic assistance guidelines for writing Writing null hypothesis and alternative problems

Writing null hypothesis and alternative problems