- QuickBooks Online, United States

- 26 people found this useful

If you’re sure you won’t be able to collect money from a customer you should write off the bad debt. There are several ways to handle a bad debt.

Please note. you should consult your accountant if you are using the accrual basis accounting method with both the following conditions:

- Not using the allowance method.

- The amount you are writing off is a high percentage of the gross sales in the year the write-off is being entered.

Look through the list and select the method that works best for your accounting system.

If you file your taxes on cash basis, the correct way to remove uncollectible amounts due is to void or delete the open invoices, since they have not been reported as income.

To Void or Delete the Invoices:

- Choose Customers .

- Click on the desired customer name on the scrollable list.

- Choose OpenInvoices from the drop-down list next to Show.

- Choose a date range from the drop-down list next to Date.

- Click on each invoice for which you will not be receiving payment, one at a time.

- When the invoice opens, on the bottom left click More Void .

- For Are you sure you want to void this?. click Yes .

- Repeat steps 4 to 6 for each invoice you need to void.

After voiding the invoice, reopen it and enter “Bad Debt” (and any other information you want to enter, such as original amount of invoice) in the memo after the word “Voided,” and then click Save .

Note: If the invoice has billable expenses, charges, credits, or time charges included on it, the program will not allow you to void.

You can select a product/service item and enter a negative amount for the total invoice. If there is sales tax, make it nontaxable first, enter the negative amount, then Save .

If the customer has partially paid an invoice:

- Open the invoice.

- Enter a new line using the main product service item in the invoice.

- Change the description to Bad Debt .

- Under the Amount field enter the balance still due as a negative number.

- In the Memo: field enter Bad Debt .

- Click Save .

If you wish to make note of the fact that the client is a bad-debt entity:

- Choose Customers .

- Click on the desired customer name on the scrollable list.

- Click Edit next to the customer name at the top of the screen.

- In the Display Name As: field type Bad Debt or No Credit after their name.

- Click Save .

This notation will not show up on invoices if you do business with them on a cash-only basis; however, it will show up in lists and reports and when you select their name to create a sales transaction.

If the amount you are writing off will significantly affect your gross sales amount, consult your accountant before making this entry.

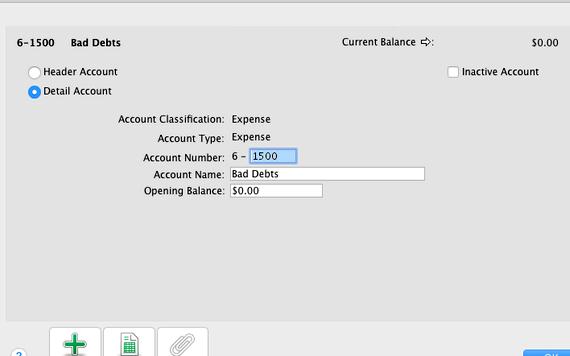

Make sure to have an uncollectible or bad debt expense account created.

- Click the Gear icon and choose Chart of Accounts .

- At the top right, click New .

- For Category type, select Expenses .

- Under Detail type, choose Bad Debts .

- Type in the name for example: ” Bad Debt” or “Uncollectible Debt .”

- Click Finish .

Create a product/service item called: Bad Debt or uncollectible Debt :

- Click on the Gear icon and choose Products and Services .

- At the top right, click New .

- Select type of item non-inventory or service .

- Type in the name.

- For the Income Account field select the “Bad Debt” or “Uncollectible Debt” expense account.

- Click Save .

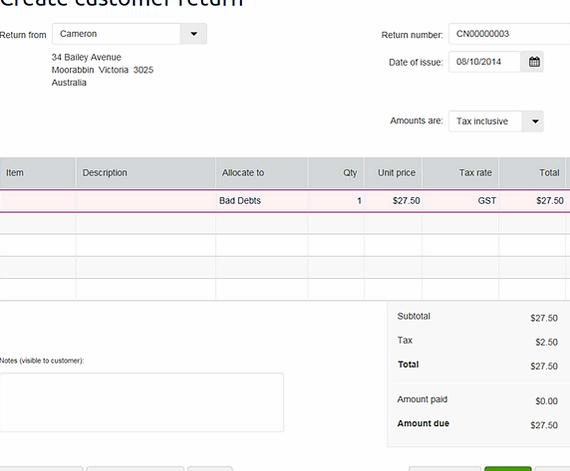

Issue a Credit Memo to the client:

- Click the “+” icon Credit Memo .

- Use the Bad Debt or Uncollectible Debt Product/Service item and enter the amount you are writing off as a positive number.

- In the Memo: field enter Bad Debt .

- Click Save .

Apply the Credit Memo:

- Click the “+” icon Receive Payment.

- Select the Customer name.

- Below the form all open transactions should be checked. If so, click Save without filling out the Receive Payment fields. If there are no transactions, click Cancel .

Allowance for Bad Debt System Already Set Up and Being Used:

If your account is set up for, and using, “allowance for bad debt,” and you need to write off an uncollectible account you can either enter a credit memo or journal entry:

First, create a product service item that uses the allowance for bad debt account:

Create a credit memo:

- Click the “+” icon Credit Memo .

- In the Customer: field select the customer name.

- For the Product/Service field, select Bad Debt .

- Under Amount enter the full amount you are writing off.

- Click Save .

Apply the Credit Memo:

- Click the “+” icon Receive Payment .

- Select the Customer name.

- Below the form, all open transactions should be checked. If so, click Save. If there are no transactions, click Cancel .

- Click the “+” icon Journal Entry .

- Enter the date.

- On the first Line:

- Under Account, select the allowance for bad debt account.

- Under Debit, enter the amount your are writing off.

- Under Memo, type something like ” To write off bad debt – [insert client name]”.

- On the second Line:

- Under Account, select Accounts Receivable.

- Under Credit, the amount should auto-populate.

- Under Memo, this should auto-populate as well.

- Under Name, select the customer name (it must not say Vendor, or Employee at the end of the name)

- In the Memo: field at the bottom, enter the same memo as the two above.

- Click Save .

- Then follow the steps above to apply the credit to the invoice(s).

Setting Up Allowance for Bad Debt System:

To set up and use the allowance method, your reporting and tax filing must be on an accrual basis.

To create an allowance for bad debt account:

- Click the Gear icon and choose Chart of Accounts .

- At the top right, click New .

- For the Category Type, select Other Current Assets* .

- For Detail type, Allowance for Bad Debts is highlighted.

- Click Save .

*Note: Australian customer choose Current Assets

To create a bad debt expense account:

To create a recurring bad debt expense journal entry, estimate what your yearly bad debt will be and divide by twelve.

- Click the Gear icon and choose Recurring Transactions .

- At the top right, click New .

- For Transaction Type:Journal Entry .

- Click OK .

- In the Template Name: field type Bad Debt .

- Under type, select Scheduled and then set desired interval for the template.

- On the first Line:

- Under Account, select the Bad Debt Expense account.

- Under Debit, enter the monthly bad debt estimated amount.

- Under Memo, type something like “Estimated bad debt”.

- On the first Line:

- On the second Line:

- Under Account, select Allowance for Bad Debt .

- Under Credit, the amount should auto-populate.

- Under Memo, this should auto-populate as well.

- In the Memo: field at the bottom, enter the same memo as the two above.

- On the bottom right click Save Template .

To create a product service item for bad debts:

From now on, when you decide to write off an uncollectible account:

- Click the “+” icon Credit Memo .

- In the Customer: field select the customer name.

- For the Product/Service field, select Bad Debt .

- Under Amount enter the full amount you are writing off.

- Click Save .

Apply the Credit Memo

- Click the “+” icon Receive Payment .

- Select the Customer name.

- Below the form, all open transactions should be checked. If so, click Save. If there are no transactions, click Cancel .

Undoing a bad debt entry when a customer pays

If a customer pays off an amount owed to you that you have already written off as bad debt, you will need to void the credit memo that was used to record the bad debt:

- Choose Customers .

- Click on the customer on the scrollable list.

- Under Transactions. click All Transactions from the drop-down list next to Show..

- Find the credit memo and double-click to open it.

- Click More Void. then click Yes to confirm.

This will keep the record of the bad debt while reinstating your customer’s balance. Now you can go to Receive Payments as you normally would to apply your customer’s payment.

Note: If you’ve already written this bad debt off in a prior year, please consult your accountant or tax preparer before making these changes.

Was this article helpful? Yes No

Ask your question to the community. Most questions get a response in about a day.

Writing pseudo code involves planning your program by writing

Writing pseudo code involves planning your program by writing Properly writing a hypothesis practice

Properly writing a hypothesis practice Re-writing the rules of the american economy

Re-writing the rules of the american economy Writing emails to customers samples

Writing emails to customers samples Writing a mystery story pdf

Writing a mystery story pdf