If your children are young, you’ve probably thought about who would raise them if for some reason you or another parent couldn’t. It’s not an easy thing to consider, but with a simple arrangement of a guardian in your will. you can feel sure that, in the extremely unlikely event you can’t raise your kids, they will be well cared for.

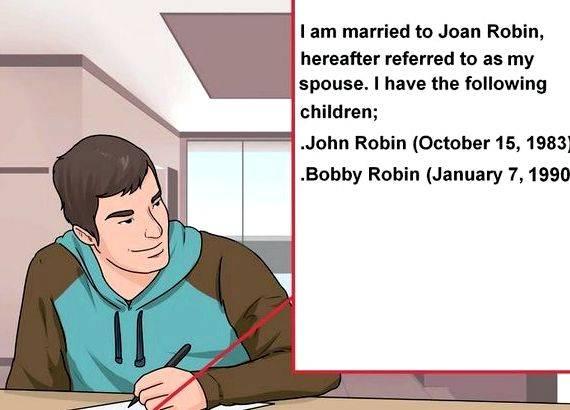

Naming a Personal Guardian

You should name one personal guardian (and one alternate, in case your first choice can’t serve) for each of your children.

Legally, you may name more than one guardian, but it’s generally not a good idea because of the possibility that the coguardians will later disagree. On the other hand, if you prefer that two people care for your child — for example, a stable couple who would act as coparents — name both of them, so that they each have the legal power to make important decisions on behalf of your child.

Here are some factors to consider when choosing a personal guardian:

- Is the prospective guardian old enough? (You must choose an adult — 18 years old in most states.)

- Does the prospective guardian have a genuine concern for your children’s welfare?

- Is the prospective guardian physically able to handle the job?

- Does he or she have the time?

- Does he or she have kids of an age close to that of your children?

- Can you provide enough assets to raise the children? If not, can your prospective guardian afford to bring them up?

- Does the prospective guardian share your moral beliefs?

- Would your children have to move?

If you’re having a hard time choosing someone, take some time to talk with the person you’re considering. One or more of your candidates may not be willing or able to accept the responsibility, or their feelings about acting as guardian may help you decide.

Choosing Different Guardians for Different Children

Most people want their children to stay together; if you do, name the same personal guardian for all of your kids.

You can, however, name different personal guardians for different children. Some parents may do this if their children are not close in age or if they have strong attachments to different adults outside of the immediate family. For instance, one child may spend a lot of time with a grandparent while another child may be close to an aunt and uncle. Or, if you have children from different marriages, they may be close to different adults. In every situation, you want to choose the personal guardian you believe would be best able to care for each child.

Choosing a Different Person to Watch the Checkbook

Some parents name one person to be the children’s personal guardian and a different person to look after financial matters. Often this is because the person who would be the best surrogate parent would not be the best person to handle the money.

For example, you might feel that your brother-in-law would provide the most stable, loving home for your kids, but not have much faith in his abilities as a financial manager. Perhaps you have a close friend who cares about your kids and would be better at dealing with the economic aspects of bringing them up. Provided that your brother-in-law and your friend agree and you trust them to get along in the best interest of your children, you can name one as personal guardian and the other as custodian or trustee to manage your children’s inheritance. (See Nolo’s article Leaving an Inheritance for Children .)

If You and the Other Parent Can’t Agree

When you and your child’s other parent make your wills, you should name the same person as personal guardian. If you don’t agree on whom to name, there could be a court fight if both of you die while the child is still a minor. Faced with conflicting wishes, a judge would have to make a choice based on the evidence of what’s in the best interests of your child.

Writing a Letter of Explanation

Leaving a written explanation may be important if you think that a judge could have reason to question your choice for personal guardian.

Judges are required to act in the child’s best interests, so in your letter explain why your choice is best for your child. Here are some issues the judge will consider:

- the child’s preference, to the extent it can be ascertained

- who will provide the greatest stability and continuity of care

- who will best meet the child’s needs

- the relationships between the child and the adults being considered for guardian, and

- the moral fitness and conduct of the proposed guardians.

If you are in either of the following situations, writing an explanatory letter may be a good idea:

If You Don’t Want the Other Parent to Raise Your Child

You may not trust your child’s other parent to care for your child if something happens to you. However, a judge will grant custody to a child’s surviving parent unless that parent has legally abandoned the child or is clearly unfit. In most cases, it is difficult to prove that a parent is unfit, unless he or she has serious problems such as chronic drug or alcohol abuse, mental illness, or a history of child abuse.

If you honestly believe the other parent is incapable of caring for your children properly, or simply won’t assume the responsibility, you should write a letter explaining why.

If Your Child’s Other Parent Is Your Same-Sex Partner

If you coparent your children with a same-sex partner, you will probably want to name your partner as the personal guardian of your children. Because some courts will be unfamiliar with your family structure, consider writing a letter to fully explain to the court why it’s important for your partner to be your children’s personal guardian.

Still having trouble choosing a guardian? For some common problems and solutions, see Nolo’s article Naming a Guardian for Your Child: Problems and Solutions .

For a comprehensive guide to estate planning, get Plan Your Estate . by Denis Clifford (Nolo), which covers everything from the basics of wills and living trusts to sophisticated tax-saving strategies.

Writing a good hypothesis worksheet high school

Writing a good hypothesis worksheet high school Wieloletnie ramy finansowe procedural writing

Wieloletnie ramy finansowe procedural writing London creative writing phd texas

London creative writing phd texas Uk phd by published work creative writing

Uk phd by published work creative writing Scholastic mystery writing unit plan

Scholastic mystery writing unit plan