LANSING, MI — The Board of State Canvassers on Thursday approved official language for Michigan Proposal 1 of 2015, a sales tax and road funding measure set to appear on the May 5 ballot.

Lawmakers proposed a constitutional amendment to raise the sales tax as part of a larger road funding package approved late last session in December, but Michigan Bureau of Elections Director Chris Thomas was tasked with crafting a “true and impartial” ballot question in 100 words or less.

While the department does not typically reference bills that would be triggered by a ballot proposal, Thomas said it would be “highly misleading” not to mention related road funding legislation in this case.

“This is a very complex proposal that is based on an interplay between proposals to change the constitution and the laws of Michigan,” he said. “Neither the proposed constitutional amendment nor the related laws can stand alone.”

Thomas got feedback from supporters and opponents, wrote two different drafts and on Thursday made one amendment to the ballot language, which was approved by the board in a 3-1 vote. Read the official question below:

A proposal to amend the State Constitution to increase the sales/use tax from 6%

to 7% to replace and supplement reduced revenue to the School Aid Fund and local units of government caused by the elimination of the sales/use tax on gasoline and diesel fuel for vehicles operating on public roads, and to give effect to laws that provide additional money for roads and other transportation purposes by increasing the gas tax and vehicle registration fees.

The proposed constitutional amendment would:

- Eliminate sales / use taxes on gasoline / diesel fuel for vehicles on public roads.

- Increase portion of use tax dedicated to School Aid Fund (SAF).

- Expand use of SAF to community colleges and career / technical education, and

- prohibit use for 4-year colleges / universities.

- Give effect to laws, including those that:

- Increase sales / use tax to 7%, as authorized by constitutional amendment.

- Increase gasoline / diesel fuel tax and adjust annually for inflation,

- increase vehicle registration fees, and dedicate revenue for roads and other transportation purposes.

- Expand competitive bidding and warranties for road projects.

- Increase earned income tax credit.

Should this proposal be adopted?

Ten individuals and attorneys offered feedback on the ballot language Thursday before approval by the board, many praising Thomas’ effort but arguing that the language did not fully describe the constitutional amendment and related laws.

“This task was impossible to sum up in 100 words,” said John Milne of Saginaw, a private citizen who urged the board not to “rubber stamp” the measure just because there were not better options.

The proposal, along with the other laws that it would trigger, is projected to eventually generate $1.25 billion a year for roads and bridges, according to the non-partisan House Fiscal Agency.

The combination package would also raise $200 million a year in new money for schools, $111 million for cities, $116 million for mass transit and $173 million for the general fund once fully implemented in fiscal year 2018.

Jonathan Oosting is a Capitol reporter for MLive Media Group. Email him. find him on Facebook or follow him on Twitter .

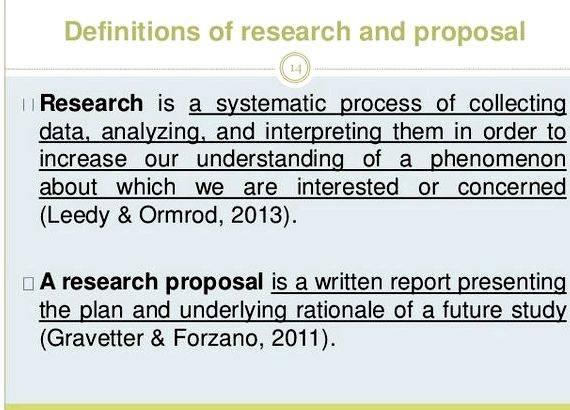

Sample chapter 3 dissertation proposal

Sample chapter 3 dissertation proposal Two ways of seeing a river thesis proposal

Two ways of seeing a river thesis proposal Communication design thesis project proposal ppt

Communication design thesis project proposal ppt Rijksuniversiteit groningen master thesis proposal

Rijksuniversiteit groningen master thesis proposal The myth of the cave thesis proposal

The myth of the cave thesis proposal