Literature Review

2. Introduction

To be able to better be aware of origin along with the idea behind the Efficient Market Hypothesis (EMH), the first section handles presenting the EMH. Section 2 handles the Random Walk Model this is a close counterpart within the EMH. You have to have see the different levels of understanding efficiency available, namely the weak form efficiency, semi-strong form efficiency along with the strong form efficiency. In section 4, there is a summary from the different sorts of record tests which have been based in the literature to look into the weak form efficiency. Section 5 explains the implications of efficient markets for investors. Section 6..

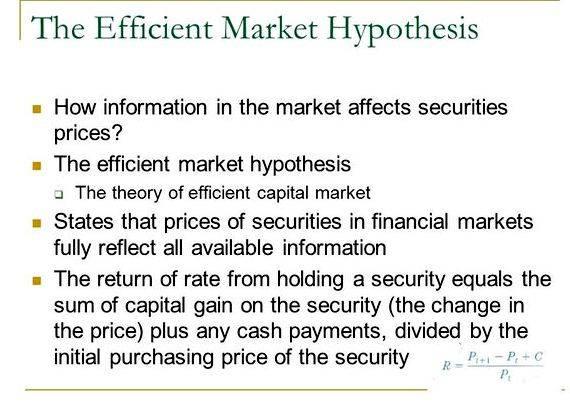

2.1 Efficient Market Hypothesis (EMH)

The idea of efficiency is most likely the fundamental concepts in finance. Market efficiency could be a saying used in many contexts with lots of meanings. Market efficiency involves three related concepts- allocation efficiency, operational efficiency and informational efficiency.

* Allocation efficiency: An attribute in the efficient market by which capital is allotted in a way that benefits all participants. It occurs when organizations within the private and public sectors can purchase funding for the projects which is probably most likely probably the most lucrative, therefore promoting economic growth

* Operational efficiency: A marketcondition that exists when participants can execute transactions and receive services in the cost that fairly means the particular costs needed to provide them.Economists employ this term to explain the strategies by which sources are broadly-familiar with facilitate the whole process of industry.

Most commonly it is desirable that markets execute their operations at as low an expense as possible.

* Information efficiency: The particular market cost from the proportion should reflect its intrinsic value. Information efficiency helps to ensure that the observed market cost from the safety reflect information tightly related to the expense within the security. The investor can manage to earn merely a danger-adjusted return from his investment, as prices move immediately along with a neutral manner for the news.

The efficiency trying to find financial assets and assets returns refers for the data efficiency and should not be mistaken while using some other type of efficiency.

As described Rahman and Hossain (2006):

For almost any stock exchange to obtain efficient, share values should always fully reflect all relevant and available information. This definition may be expressed as ƒ(Ri,t, Rj,t φM t-1) = ƒ( Ri,t, Rj,t φM t-1, φa t-1), where ƒ(.) = a probability distribution function, Ri,t = the return on security i in period t, φM t-1 = the data set utilized by industry at t 1, φa

t-1 = the particular information item place in everybody domain at t 1. This equation has two important implications.

1. Specific information item at t-1 (φa t-1) cannot know about earn non zero abnormal return.

2. Every time a new information item is determined to the data set φM, it’s immediately reflected on market prices.

The idea of market efficiency was created by Bachelier (1900). After that, there’s numerous studies like Working (1934), Cowles and Manley (1937), Kendall (1953), Cootner (1964). Nevertheless it absolutely was Fama (1965) who first used termed it “efficient market”. Fama (1970) later stated the sufficient whilst not necessary conditions for efficiency:

i. there is not any transaction costs in exchanging securities

ii. all available details are costlessly open to all market participants, and

iii. all accept the implications of current information for the current cost and distributions of future prices of each security

Also, he identified three levels of informational efficiency namely the weak form, the semi-strong form along with the strong form.

2.2 Random Walk Model (RWM)

The Random Walk Model could be a close counterpart within the Efficient Market Hypothesis. The model was examined by Kendall (1953). It claims that stock cost fluctuations are outdoors of one another and share the same probability distribution. Thus the Random Walk theory signifies that stock cost change at random, which makes it impossible to calculate share values. The Random Walk Model originates from the concept that financial markets are efficient which investors cannot beat or predict industry because share values reflect all available information along with the new information arises at random. As outlined above in Fama (1970) the 2 ideas constituting the Random Walk Model. that’s (i) successive cost changes are independent and (ii) successive changes are identically distributed, are unconditionally assumed within the Efficient Market Hypothesis.

The Random Walk Model reaches direct opposition to technical analysis, meaning the stock’s future cost may be forecasted according to historic information through observing chart patterns and technical indicators.

2.3 3 Types of Market Efficiency

2.3.1 Weak-Form Efficiency

Fama (1970) stipulates that no investor can earn excess returns by formulating exchanging strategies according to historic cost or return information within the weak-form efficient market. The weak-form efficiency thus assumes the cost from the stock fully reflects information contained in past prices, this is actually the historic sequence of costs, rate of returns along with other historic market information. An inadequate-form efficient market ensures that it’s useless to learn technical analysis involving past prices alone to uncover undervalued stocks.

To be able to test whether past share prices allows you to predict future share prices( that’s, weak-form efficiency), record or econometric tests may be used. These studies attempt to see the evolution of share prices in one period to a new period and then identify correlation relating to the successive cost changes. Technical analysts see the evolution of past share prices, for your exact reason behind predicting share prices to create gains.

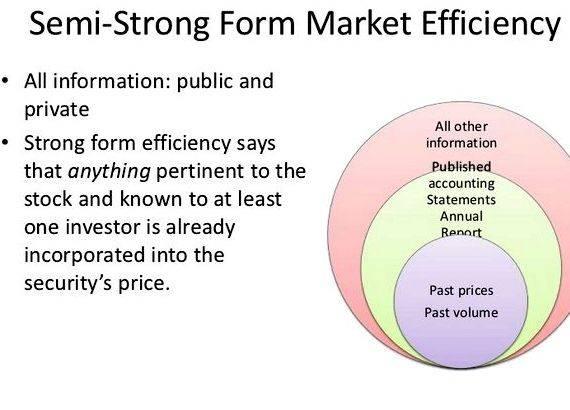

2.3.2 Semi-Strong Form Efficiency

Fama (1970) described the semi-strong form efficiency when you where share cost fully reflect information contained not just to past prices but all public information. All public information includes capital market information as based in the weak form Efficient Market Hypothesis(EMH) furthermore to non-market information for example earnings, dividend bulletins, cost earnings ratio, specifics of the economy and political news (Reilly1997). New public details are rapidly integrated in share cost along with the share cost is adjusted so that you can reflect the particular cost from the share. Meaning a trader cannot use public information to create gains around the stock exchange.

To be able to test for semi-strong form efficiency, event studies generally used. These event studies produced by analyzing the finish increase the risk for relieve new public details concerning the share cost. When the information mill semi-strong form efficient, the brand-new public information ( as an example annual reports, earning announcement or dividend announcement) is quickly integrated within the share cost, so that you can reflect the intrinsic cost from the share. New information may be both negative or positive. Thus they might cause increases or decreases inside their release.

2.3.3 Strong Form Efficiency

Under strong form efficiency, the present cost reflects information, public furthermore to non-public. Personal information, during this context, means information not printed. Around the stock exchange, you will find professionals (for instance security analysts, fund managers) who’ve private furthermore to public information. Efficient Market Hypothesis (EMH) assumes that no investor has monopolistic usage of any information. Meaning as new private and public details are freed, it’s incorporated in share cost to mirror it’s true value. A trader won’t be capable of consistently find undervalued or overvalued shares making gains across the strong form efficient market. Fama (1970) perceives a effective form efficient market when you where investors aren’t vulnerable to earn excess returns by counting on inside information.

To evaluate whether past share prices, private and public information can acquainted with predict future share prices, a great investment records and gains generated by professional investors are frequently studied. Investors shouldn’t be consistently capable of making gains by using private and public information. Whatsoever moments, the proportion prices incorporate all private and public information to mirror the particular cost from the shares.

2.4 Record Tests to look at validity of Weak-Form EMH

To be able to see the validity within the weak form efficiency, numerous record exams are really based in the literature. These tests may be categorized into two groups:

i. Using mechanical exchanging rules also known as filter rules.

These rules test for the opportunity of non-straight line dependence existing within the cost data. Filter rules were first utilized by S.A Alexander (1961) then Fama and Blume (1966) make the literature. Professor Alexander’s filter techniques tries to employ a sophisticated criteria to understand movements available prices. An x percent filter is identified as follows: When the daily closing cost from the specific security increases no under x percent, buy and support the security until your money moves lower no under x percent within the subsequent high, and selling and go short (Fama and Blume, 1966). Rapid position will probably be maintained before the daily closing cost increases no under x percent around the subsequent low whenever you covers and purchase. Moves under x percent both in direction are overlooked.

ii. Record tests of independence between successive cost changes.

Serial autocorrelation tests and run exams are probably the most broadly used tests. A few in the researches in this particular subject use Spectral Analysis which decomposes some time series in a spectrum of cycles of several length. This spectral decomposition of occasions series yield a spectral density function that measures the contribution of all of the frequency bands for that overall variance within the occasions series. There’s in addition a somewhat recent test created by Lo and Mackinlay (1988), it’s name may be the Variance Ratio which draws on the heteroscedasticity problem. The fundamental idea behind the Lo and Mackinlay (1988) variance-ratios test occurs when an exciting-natural logarithm of occasions series could be a pure random walk, then, the variance from the k-variations within the finite sample grows linearly while using the difference, Let (pt) denote some time series comprised of T observations p1,p2,,pT of asset returns. Then, the variance-ratio within the k-th difference, VR(k), is identified as:

where, VR(k) may be the variance-ratio within the share’s returns k-th variations σ2(k) may be the impartial estimator of just oneOrnited kingdom within the variance within the share’s returns k-th variations, underneath the null hypothesis σ2(1) may be the variance within the first-differenced share returns series, and k is the amount of occasions of base observations interval or lag (Ntim et al. 2007).

2.5 Implications of EMH

Market efficiency has important implications for investors and government physiques. In situation your information mill inefficient, investors should doubt the “support the market” strategy and could try and “beat industry”. Since the government physiques on their own part should restructure the stock exchange by enacting effective law and enhancing financial media.

The graph below shows brought on by EMH on share values.

The straight line shows the response under EMH since the dotted lines show the over-reaction and under-reaction that occur with the presence of market imperfections.

In situation your information mill efficient, investors:

1. shouldn’t be worried about investment analysis. They have to rather focus on holding a properly diversified portfolio. Investors holding an inefficient diversified portfolio will most likely be uncovered to risk which may be prevented as well as for which they aren’t really rewarded. Essentially, industry only provides return for systematic risk, while specific risks need to be diversified away.

2. Should adopt a buy and hold policy after they established their portfolios. Because there’s no advantage in altering in one volume of securities to a different. This way, there’d be transaction costs they’re going to have to incur and thus, the danger-adjusted return may be affected. Altering the composition in the portfolio could only be justified

a) when the risk exposure has altered because of relative changes in the marketplace cost from the constituent securities.

b) if tax payments may be minimized.

Other implications of EMH are:

* Cost changes are random and unpredictable

* Investors aren’t easily fooled using the glossy fiscal reports or ‘creative accounting’ techniques

* Timing of recent difficulties with securities aren’t important since prices represent the intrinsic and could reflect the grade of risk within the share.

Thus under EMH neither fundamental nor technical analysis allows you to achieve superior gains. Investors should focus on constructing and holding efficiently diversified portfolios.

2.6 Empirical Evidences

While using literature, it may be seen there are 2 competing schools of ideas about market efficiency. The first school argues that financial markets are efficient and thus, returns cannot be predicted. For instance early studies (Working, 1934 Kendall, 1943, 1953 Cootner, 1962 Osborne, 1962 Fama, 1965) on developed markets supply the weak form efficiency on the market obtaining a minimal volume of serial correlation and transaction cost. The studies during this way of thinking, supply the Efficient Market Hypothesis (EMH) and show cost changes couldn’t know about forecast future cost changes, especially after transaction costs were considered.

The 2nd school, however, provides empirical proof of ‘anomalies’ that contradict the idea of efficient markets. A few of individuals studies Summers (1986), Keim (1988), Fama and French (1988), Lo and MacKinlay (1988) and Poterba and Summers (1988). They found some ‘anomalies’, that won’t described using the theory of Fama (1965). A few in the market anomalies they found are:

· The month from the month of the month of january Effect/Turn of the year Effect

Stock returns are often abnormally high with the initial couple of occasions in the month from the month of the month of january. The The month from the month of the month of january effect occurs because many investors decide to sell a few from the stock before the finish of the year to be able to claim a capital loss for tax purposes. They rapidly reinvest their after 2012, causing share values to enhance. Rozeff and Kinney (1976) was among the finest to exhibit this currency exchange market anomaly. Rozeff and Kinney (1976) methodology gives smaller sized sized sized companies greater relative influence than may be true in value-weighted indices where large firms dominate. Subsequent researches (Reinganum, 1983 Roll, 1983, amongst others) later ensure the The month from the month of the month of january result can be a little cap phenomenon.

· Size Effect/Small Firm Effect

The Size Effect may be the inclination for firms obtaining a little market capital to outshine bigger companies within the extended term. For instance Banz (1981) and Reinganum (1981) proven that small-capital firms across the New You can Stock Market (New you’ll be able to stock exchange) earned coming back more than exactly what do be predicted using the Sharpe (1964) Linter (1965) capital asset-prices model (CAPM) from 1936-1975. However as outlined above by G.W. Schwert(2003, p.943), it appears the small-firm anomaly has disappeared because the initial publication within the papers that discovered it. Alternatively, the differential risk premium for small-capital stocks has decreased with time.

· Weekend Effect/Day Effect

This really is frequently a phenomenon by which stock returns on Mondays are frequently considerably under individuals within the immediately preceding Friday. French (1890) observed this anomaly. He noted the normal go back to the standard and Poor’s (SP) Composite Portfolio was reliably negative over weekends within the periods 1953-1977. Again, such as the size effect, the weekend effect appears to possess disappeared, or in the best substantially attenuated, since it was documented in 1980.

· Value Effect/Cost Earnings Ratio Effect

The worth effect means inclination for stocks with affordable earnings ratio to outshine portfolios comprised of stocks obtaining a greater cost earnings ratio. Basu (1977) ensures that investors holding affordable earnings ratio portfolio earned greater returns.

The presence of market anomalies have important implications. If stock returns sweets a random process, you’ll be able to design lucrative exchanging strategies according to historic information

2.6.1 Empirical Evidences from Developing Countries

Regardless of the many empirical studies which have been conducted to look for the validity within the Efficient Market Hypothesis (EMH) in civilized world with booming markets, studies to help or dispute the efficiency or inefficiency within the African stock financial markets are quite limited. There is a small little bit of empirical studies analyzing emerging African equity markets in relation to weak type of market efficiency test. While a few of individuals research has analysed single markets ( e.g. Samuels and Yacout 1981 Parkinson 1984 Ayadi 1984 Dickinson and Muragu 1994 Osei 1998 Olowe 1999 Mecagni and Sourial 1999 Asal 2000 Adelegan, 2004 Dewotor and Gborglah, 2004 Ntim et al. 2007), others have analysed categories of nations (e.g. Claessens et al. 1995 Magnusson and Wydick, 2002 Cruz et al. 2002 Appiah-Kusi and Menya, 2003 Simons and Laryea, 2004 Jefferis and Cruz, 2005).

However, while there are just a number of empirical studies, their conclusions in regards to the efficiency and predictability of future stock returns are really mixed. For instance Dickinson and Muragu (1994) ensures that the Kenyan stock exchange is weak form efficient, rather from the link between Parkinson (1984).

Also, many of the existing studies utilized conventional weak form testing methods for example serial correlation tests. Samuels and Yacout (1981) and Parkinson (1984) were among the finest to make use of serial correlation tests to look into the weak form efficiency on cameras. Samuels and Yacout analysed the weak form market efficiency in weekly cost volume of 21 listed Nigerian firms from 1977 to 1979 and provided empirical evidence industry was efficient. Parkinson on his part, analysed monthly cost volume of 30 listed Kenyan firms from 1974 to 1978 and rejected the weak form efficiency. Dickinson and Muragu (1994) reinvestigated the Kenyan market through the use of run and serial correlation tests to weekly stock cost volume of 30 listed companies across the Nairobi Stock Market additionally for their effects were compared to Parkinson (1984). They proven that successive cost changes are outdoors of one another for many the businesses investigated.

Many of the developing countries experience the issue of thin exchanging (Mlambo and Biekpe, 2005). The issues introduced on by thin exchanging are really broadly acknowledged in financial market researches (e.g. Dimson, 1979 Cohen et al. 1983 Butler and Simonds, 1987 Lo and Mackinlay, 1990a and b Bowie, 1994 Muthuswamy and Whaley, 1994). Fisher (1966) who had previously been the very first ones to know the bias introduced on by thin exchanging within the serial correlation of index returns, described that recorded prices of securities aren’t always comparable to their underlying theoretical values. Because every time a share doesn’t trade, the cost recorded remains closing cost once the share was last traded.

However, while many of the African stock markets experience thin exchanging, many existing studies don’t adjust for thin exchanging. For instance research studies conducted round the stock market of Mauritius (Appiah-Kusi and Menya, 2003 and Simons and Laryes, 2004) made used of conventional techniques and didn’t adjust for thin exchanging. Other studies (Kabba, 1998 Roux and Gilberson, 1978 and Poshawale, 1996) that have examined the conduct of stock cost and rejected the weak-form efficiency, have described the inefficiency may be because of delay in operations and transaction cost, thinness of exchanging and illiquidity in the marketplace.

This essay and seven,150 most people are purely open to folks!

We’re the global most preferred study website. Better still – membership is provided for free.

Bear in mind the disposable essay that you simply were just studying wasn’t printed by us. This essay, and more open to view online, received to all of us by students to get services that folks offer. This relationship helps our students to get an even better deal although adding for that finest free essay resource within the United kingdom!

Request Removal

If you’re the very first author in the essay with no longer want the essay printed across the United kingdom Essays website then please go here below to request removal:

Request removing this essay

Bear in mind the disposable essay that you simply were just studying wasn’t printed by us. This essay, and more open to view online, received to all of us by students to get services that folks offer. This relationship helps our students to get an even better deal although adding for that finest free essay resource within the United kingdom!

Custom written use Undergraduate and Masters students

Put Your ORDER TODAY

Order Now Using our private ordering system

Writing a letter to the president of your college

Writing a letter to the president of your college Dear darlin please excuse my writing i cant stop

Dear darlin please excuse my writing i cant stop Writing new years resolutions with your students are lucky

Writing new years resolutions with your students are lucky Shikin haramitsu daikomyo kanji writing

Shikin haramitsu daikomyo kanji writing Properly writing a hypothesis practice

Properly writing a hypothesis practice