Erik De Castro/ReutersAmid persistent anemic global growth and signs that central-bank policy is losing its potency, investors should brace for “under normal returns exceeding normal risk”.

Ray Busacca/GettyRay Dalio, the best choice within the world’s largest hedge fund, Bridgewater Assets, is anxious about rise on the planet economy. As they sees it, there’s no “locomotive” drive an automobile growth. Within the last couple of years, China has driven another of all of the growth on the planet, but it is slowing lower, that will be a continue global growth.

Ray Dalio thinks the Given will raise rates soon — but history allows us to know that may be too early.

Ray Dalio is warning the dynamic capitalism draws on is crumbling.

Because of the Federal Reserve’s extreme financial policy, “the aim return of asset classes is extremely narrow,” warns Bridgewater’s Ray Dalio, with expected returns for equities of “no more than 4 %.In . This really is frequently an issue, he explains during this brief clip, as financial policy is determined by that transmission mechanism of apparent wealth creation to help keep the dream alive. In Europe and Japan there’s no “spread”, Dalio notes, plus america it’s small – meaning financial policy is really ineffective.

Similar to we first cautioned in September 2013, in order that it appears the scene of helicopter money being imminent is becoming a lot more mainstream because the forces that be progressively propagandize the advantages.

While Ray Dalio has held various strong opinions across the markets along with the global economic climate (sadly his “beautiful deleveraging” thesis switched to become “monstrous releveraging” along with negative rates) as behooves your mind within the world’s largest hedge fund, he’s rarely embarked into social or political commentary.

Which is the reason i used to be surprised to listen to him discuss what is considered the most dominant subject during the day in recent a few days: Jesse Trump.

CNBC’s Andrew Ross Sorkin and Becky Quick, donning the most amazing goose lower bubble jackets to help help help remind viewers they’re reporting live from scenic Davos, generously needed a while utilizing their busy schedules to speak to Ray Dalio on Wednesday and unsurprisingly, the “zen master” again predicted the Given will reverse course and attempt more QE. Dalio begins by noting the Fed’s visit inflate financial assets by pumping money somewhere means there’s an “asymmetric risk across the downside.”

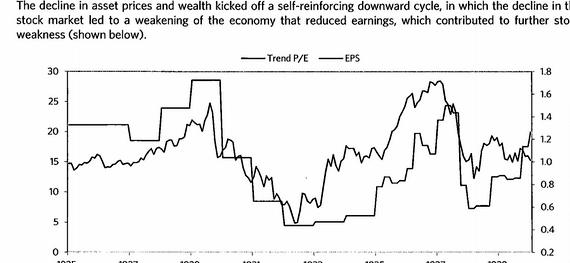

A few days ago, we wanted overview of why zen master Ray Dalio’s All Weather fund has gotten trouble riding the quantity of violent thunderstorms which have shaken industry recently. The end result is, “the historic relationships between asset classes (volatilities and correlations) that are widely-used to construct optimal “risk-parity” funds to make sure that ‘risk’ is balanced and hedged across bonds and stocks (for instance) broke lower dramatically.”

Printed by Lance Roberts of Street Talk Live blog,

Phd thesis writing services in bangalore dating

Phd thesis writing services in bangalore dating Methodology sample for thesis proposal

Methodology sample for thesis proposal Network control system thesis proposal

Network control system thesis proposal University of michigan library thesis dissertations

University of michigan library thesis dissertations Semantic web mining thesis proposal

Semantic web mining thesis proposal