Our Guarantees Our Quality Standards Our Fair Use Policy

How Come United kingdom Essays Different?

- There is a verifiable exchanging history as being a United kingdom registered company (details within the finish of every page).

- Our Nottingham offices are suitable for purchase to everybody to satisfy we greater than 40 full-time staff.

- United kingdom Essays partner with Feefo.com to produce verified customer testimonials – both positive and negative!

Ask an expert FREE

Ask an expert Index Ask an issue Compensated Services

About Our Ask an expert Service

Our free of charge “Ask a specialistInch Service enables users to get a solution as much as 300 words for the academic question.

- Questions typically clarified within 24 hrs.

- All solutions are researched and printed by properly accredited academics within the question’s market.

- Our services are totally private, only the solution is printed – we never publish your very own details.

- Each professional answer includes appropriate references.

About Us

More Details On Us

Plagiarism-free

Always rapidly

Marked to plain

Define quantity of aggregation desegregation

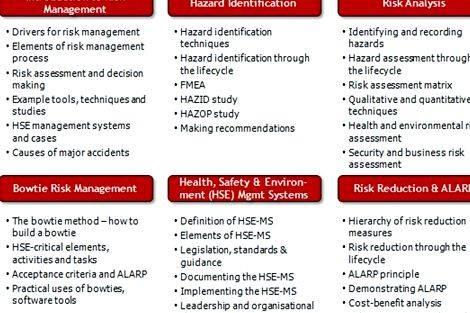

Will most likely be in the greater level in comparison with an in depth project uncertainty analysis

Use Monte Carlo calculation

Ideas can talk over some things what exactly are subject for that project management software software software that are helpful for overcoming towards the context in the industry the end result is and extended run getting all of the options taken underneath the factors

Once we complement planning something we have to try searching in performing something, searching something and creating steps to workout our planning by permitting proper planning which we known as correct management if for credit risk management the banking organizations needs to be evaluated correctly.

The next questions must be attracted in your mind

The pain you are getting ready to do in handling the risk management?

What’s our approach in performing it?

Now just when was the most effective time to handle the beginning?

What are prerequisites to accomplish?

What period of time does it require?

What would be the cost require to accomplish it?

These questions are often requested at initiating of each project and solutions would be the structures the entire project stands – clarifying what we should should do together with what you ought to achieve the end result is term planning and extended term planning.

Structured project management software software software method to handle project in logical well defined and relevant method adopted

These questions are true prerequisite for almost every project to initiate and directed to find the best direction using the best equipments and techniques adopted with techniques the job goes the most effective direction towards goal achieving.

Section 3: Hypothesis Testing.

Research Design:

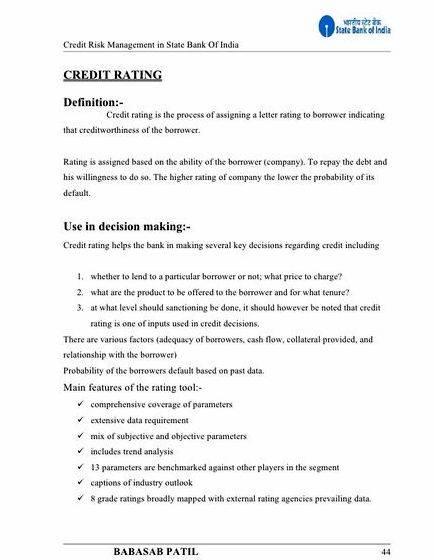

Prior research finds that banks manage credit risk for two main primary purposes: to enhance interest earnings (profitability) and to reduce loan losses (bad obligations) which ends up up from credit default (Sim, 2006).

We predict that banks with better credit risk management practice have lower loan losses (non performing loans). We use profitability (ROA, ROE) as proxy for credit risk management indicators.

Accordingly we’ve the next ideas:

Hypothesis:

Banks occupying greater profitability (ROE, ROA) shows lower loan losses (Non-Performing Loans/ Total Loans).

Banks getting greater interest earnings (internet interest/Average total assets, interest internet /total earnings) also shows lower bad loans (NPL).

It concludes that folks test the hypothesis when using the following regression model:

P (ROA, ROE) = ± + NPL/TL+µ €¦€¦€¦€¦€¦€¦€¦€¦€¦€¦. (7)

Where, NPL depicts non-performing loans, TL denotes whole loan and P denotes profitability (ROA, ROE). Also, ± may be the intercept and may be the parameter of explanatory variable ROA and ROE, µ represents the disturbance terms.

Data description

We make use of the datat inside the concerned banks for research to the credit risk management that is overcoming methods. Time-series research in to the 5 year financial data of Bank may also be attracted in your mind to discover the outcomes of profitability (ROE and ROA, individually) which are performance indicators and loan losses (NPL/TL) which represent the lent funds risk management effectiveness for virtually any organization.

Section 4: Conclusion and Suggestions

Conclusion:

Situation study concludes the financial institution(s) uses various credit risk management techniques/methods/tools and assessment modules to deal with credit risks faced by them, additionally they occupy one common objective that’s to reduce the quantity of loan default that’s principal cause of the financial institution failure the end result is and extended term planning in anxiety about credit

SUGGESTIONS:

The next suggestions may be helpful for the banking organization

Participation in portfolio within the planning and charge of the organization in extended run

Developing Credit sanction Authority configuration.

Approving the main credits risks within the management organization

Giving way sanction authority to qualified individuals.

Reviewing the adequacy of credit preparation inside the organization in connect with the lent funds risks

Founding of credit policies and values that obey the guidelines to regulatory needs along with the bank’s overall objectives.

Counterparty ratings, are acquired completely while using local permitted and exterior Credit Score Agencies

Assessment along with the permanent monitoring of counterparty and portfolio credit exposures is voted out,

This Essay is

This essay remains printed getting students. This isn’t one of the task printed by our professional essay authors.

Types of our work

Setting systems to know important portfolio indicators, problem credits and quantity of provisioning needed.

Presents specifics of the bank’s reference to that is management and charge of credit risks, as time passes

Request Removal

If you’re the very first author in the essay with no longer want the essay printed across the United kingdom Essays website then please go here below to request removal:

More from United kingdom Essays

James hayton phd thesis proposal

James hayton phd thesis proposal Chen lung hung thesis proposal

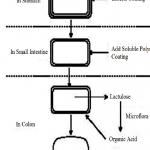

Chen lung hung thesis proposal Colon targeted drug delivery system dissertation proposal

Colon targeted drug delivery system dissertation proposal Planning report master thesis proposal

Planning report master thesis proposal Richard white middle ground thesis proposal

Richard white middle ground thesis proposal