The Prebisch-Singer and Myrdal thesis of failing relation to trade

Based on Gunnar Myrdal, the circumstances in underdeveloped countries are so that “spread” results of trade tend to be more than offset through the “backwash” effects.

For instance, widening of markets that comes with move benefits first and foremost the wealthy and progressive countries whose manufacturing industries possess the lead and therefore are already prepared through the surrounding exterior economies as the underdeveloped countries face the possibility of seeing the extinction of the industries (since their small- scale industries and handicrafts cost out by cheap imports in the industrial countries).

The historic experience with many underdeveloped countries confirms this because the duration of colonial domination of those countries was characterised with a large-scale destruction of the handicrafts and small- scale industries. These countries were changed into exporters of primary goods.

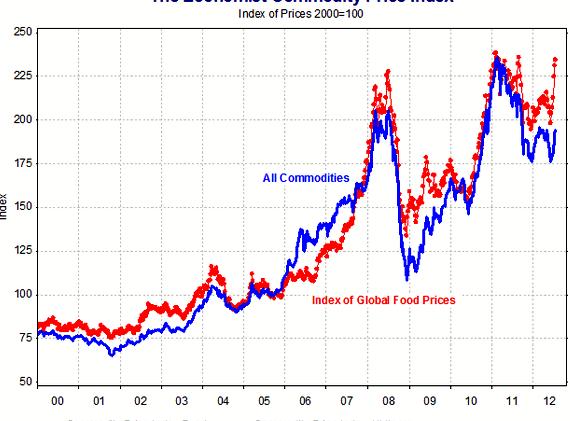

The disadvantages of the conversion were many because the primary goods exports frequently meet inelastic demands within the worldwide market, a requirement trend that isn’t rising quickly, and excessive cost fluctuations. The benefits of any technological enhancements within their export production (resulting in cheapening of production) also have a tendency to get used in the importing countries.

Due to these reasons, Myrdal argues the pattern of production within the underdeveloped countries reflects the ‘backwash effects’ of worldwide trade instead of any true comparative advantage. Therefore, worldwide trade strengthens the forces maintaining stagnation and regression within the underdeveloped countries.

The controversy on relation to trade of developing countries really started using the report from the first session from the Sub-Commission on Economic Growth and development of the United nations Economic and Employment Commission which contended that increase in the costs of capital goods had made the job of monetary development harder for that developing countries.

The report known as for any research of relative prices of capital goods and primary products. As a result of this request, the United nations Department of monetary Matters printed a study titled “Relative Prices of Exports and Imports of Underdeveloped Countries,” in December 1949.

The main finding of the report was that index of the number of prices of primary products to individuals of manufactured products shows a declining trend, from 147 for that period 1876 to 1880 to 100 to 1938. The declining trends as noted above within the relation to trade for primary products from the developing countries gave rise towards the famous Prebisch-Singer thesis.

Based on the figures presented through the United nations Department of monetary Matters in 1949, Raoul Prebisch asked the mutual profitability of worldwide trade as guaranteed through the traditional free trade theory. Focusing on the expansion experience with Latin American countries, he contended their failing relation to trade had inhibited their economic development.

He divided the planet into industrial ‘centres’ and ‘peripheral’ countries and contended that underneath the nineteenth century plan of products, the particular task allotted to peripheral (i.e.

underdeveloped) countries ended up being to produce food and recycleables for that great industrial centres.

Under this plan of products there wasn’t any provision for that industrialisation from the underdeveloped countries. This arrangement only ensured their economic exploitation as a result of the commercial centres.

Technical Progress and Relation to Trade.

Based on Prebisch, the popularity towards exterior imbalance within the developing countries is principally due “towards the disparity between your rate of development of their primary exports and also the rate of development of their imports of commercial goods. While primary exports, with certain exceptions, develop fairly gradually, interest in industrial imports has a tendency to accelerate.

This can be a spontaneous feature of monetary development. Now, argues Prebisch, the slow development of primary exports is definitely an inevitable consequence of technological progress within the industrial centres because it results in the growing substitution of synthetics for natural products and it is reflected in some way within the smaller sized raw material content of finished goods.

Another essential sign of technical progress is it continues to be limited to industrial production for any lengthy some time and spread towards the farming sector very late. If this did achieve the farming sector finally, the advantages were again restricted to USA and Europe for several years.

The large rise in farming output that ensued within the major industrialised countries further weakened the export trade in many farming products from the developing countries.

Furthermore, inside a bid to ensure domestic consumer marketplace for the elevated farming output, the civilized world frequently resorted to limitations on imports from developing countries. Thus, inside a bid to resolve their very own domestic problems, the industrialised countries have irritated the issues from the developing countries.

The Earnings Elasticity of Interest in Products, Balance of Payments and Relation to Trade. Additionally to technical progress resulting in degeneration when it comes to trade for developing countries, Prebrisch also views the total amount of payments results of variations within the earnings elasticity of interest in various kinds of products.

It’s generally recognised and agreed the earnings elasticity of interest in most primary goods is gloomier than that for manufactured products. Actually, the earnings elasticity of interest in primary products is under unity to ensure that a decreasing proportion of earnings is allocated to these items as earnings increases (generally knows as Engel’s law in Financial aspects).

Since developing countries would be the exporters of primary products and civilized world would be the exporters of manufactured products, which means that “for any given development of world earnings the total amount of payments of primary-producing, developing countries will instantly deteriorate vis-a-vis the total amount of payments of civilized world producing and conveying industrial goods.”

The Prebisch-Singer and Myrdal thesis of failing relation to trade

Based on Gunnar Myrdal, the circumstances in underdeveloped countries are so that “spread” results of trade tend to be more than offset through the “backwash” effects.

For instance, widening of markets that comes with move benefits first and foremost the wealthy and progressive countries whose manufacturing industries possess the lead and therefore are already prepared through the surrounding exterior economies as the underdeveloped countries face the possibility of seeing the extinction of the industries (since their small- scale industries and handicrafts cost out by cheap imports in the industrial countries).

The historic experience with many underdeveloped countries confirms this because the duration of colonial domination of those countries was characterised with a large-scale destruction of the handicrafts and small- scale industries. These countries were changed into exporters of primary goods.

The disadvantages of the conversion were many because the primary goods exports frequently meet inelastic demands within the worldwide market, a requirement trend that isn’t rising quickly, and excessive cost fluctuations. The benefits of any technological enhancements within their export production (resulting in cheapening of production) also have a tendency to get used in the importing countries.

Due to these reasons, Myrdal argues the pattern of production within the underdeveloped countries reflects the ‘backwash effects’ of worldwide trade instead of any true comparative advantage. Therefore, worldwide trade strengthens the forces maintaining stagnation and regression within the underdeveloped countries.

The controversy on relation to trade of developing countries really started using the report from the first session from the Sub-Commission on Economic Growth and development of the United nations Economic and Employment Commission which contended that increase in the costs of capital goods had made the job of monetary development harder for that developing countries.

The report known as for any research of relative prices of capital goods and primary products. As a result of this request, the United nations Department of monetary Matters printed a study titled “Relative Prices of Exports and Imports of Underdeveloped Countries,” in December 1949.

The main finding of the report was that index of the number of prices of primary products to individuals of manufactured products shows a declining trend, from 147 for that period 1876 to 1880 to 100 to 1938. The declining trends as noted above within the relation to trade for primary products from the developing countries gave rise towards the famous Prebisch-Singer thesis.

Based on the figures presented through the United nations Department of monetary Matters in 1949, Raoul Prebisch asked the mutual profitability of worldwide trade as guaranteed through the traditional free trade theory. Focusing on the expansion experience with Latin American countries, he contended their failing relation to trade had inhibited their economic development.

He divided the planet into industrial ‘centres’ and ‘peripheral’ countries and contended that underneath the nineteenth century plan of products, the particular task allotted to peripheral (i.e. underdeveloped) countries ended up being to produce food and recycleables for that great industrial centres.

Under this plan of products there wasn’t any provision for that industrialisation from the underdeveloped countries. This arrangement only ensured their economic exploitation as a result of the commercial centres.

Technical Progress and Relation to Trade.

Based on Prebisch, the popularity towards exterior imbalance within the developing countries is principally due “towards the disparity between your rate of development of their primary exports and also the rate of development of their imports of commercial goods. While primary exports, with certain exceptions, develop fairly gradually, interest in industrial imports has a tendency to accelerate.

This can be a spontaneous feature of monetary development. Now, argues Prebisch, the slow development of primary exports is definitely an inevitable consequence of technological progress within the industrial centres because it results in the growing substitution of synthetics for natural products and it is reflected in some way within the smaller sized raw material content of finished goods.

Another essential sign of technical progress is it continues to be limited to industrial production for any lengthy some time and spread towards the farming sector very late. If this did achieve the farming sector finally, the advantages were again restricted to USA and Europe for several years.

The large rise in farming output that ensued within the major industrialised countries further weakened the export trade in many farming products from the developing countries.

Furthermore, inside a bid to ensure domestic consumer marketplace for the elevated farming output, the civilized world frequently resorted to limitations on imports from developing countries. Thus, inside a bid to resolve their very own domestic problems, the industrialised countries have irritated the issues from the developing countries.

The Earnings Elasticity of Interest in Products, Balance of Payments and Relation to Trade. Additionally to technical progress resulting in degeneration when it comes to trade for developing countries, Prebrisch also views the total amount of payments results of variations within the earnings elasticity of interest in various kinds of products.

It’s generally recognised and agreed the earnings elasticity of interest in most primary goods is gloomier for manufactured products. Actually, the earnings elasticity of interest in primary products is under unity to ensure that a decreasing proportion of earnings is allocated to these items as earnings increases (generally knows as Engel’s law in Financial aspects).

Since developing countries would be the exporters of primary products and civilized world would be the exporters of manufactured products, which means that “for any given development of world earnings the total amount of payments of primary-producing, developing countries will instantly deteriorate vis-a-vis the total amount of payments of civilized world producing and conveying industrial goods.”

Classroom without walls thesis writing

Classroom without walls thesis writing Turner thesis definition in writing

Turner thesis definition in writing Social policy phd thesis proposal

Social policy phd thesis proposal References in phd thesis writing

References in phd thesis writing On going home joan didion thesis proposal

On going home joan didion thesis proposal