Assignment:

Part I

1. For each of the scenarios below, explain whether or not it represents a diversifiable or an undiversifiable risk. Please

consider the issues from the viewpoint of investors. Explain your reasoning

a. There’s a substantial unexpected increase in inflation.

b. There’s a major recession in the U.S.

c. A major lawsuit is filed against one large publicly traded corporation.

2. Use the CAPM to answer the following questions:

a. Find the Expected Rate of Return on the Market Portfolio given that the Expected Rate of Return on Asset &”i&” is 12%, the

Risk-Free Rate is 4%, and the Beta (b) for Asset &”i&” is 1.2.

b. Find the Risk-Free Rate given that the Expected Rate of Return on Asset &”j&” is 9%, the Expected Return on the Market

Portfolio is 10%, and the Beta (b) for Asset &”j&” is 0.8.

c. What do you think the Beta (β) of your portfolio would be if you owned half of all the stocks traded on the major

exchanges? Explain.

3. In one page explain what you think is the main ‘;message’ of the Capital Asset Pricing Model to corporations and what is

the main message of the CAPM to investors?

Part II:

American Superconductor

As you know from reading through the background materials, the decision to use debt or equity to raise money is not a

decision taken lightly by management. So when several years ago, in 2003 American Superconductor decided to raise funds

through equity it was definitely a major decision that required intense discussions at the highest levels of management.

Read the article below about American Superconductor and do some of your own research using the CyberLibrary and internet

search engines.

You can also take a look at the official American Superconductor webpage.

After doing your research, apply what you learned from the background materials and write a two to three page paper answering

the following questions:

What are the advantages and disadvantages for AMSC to forgo their debt financing and take on equity financing? Do you agree

with their decision? How can a company’s cost of equity be determined? Is there a tax deduction from the use of debt

financing? Please explain.

Explain both of your answers thoroughly. Be sure to support your opinions on these assignment questions with references to

the background materials or to other articles in your paper.

Read the article below available in Proquest:

American Superconductor switch ; Westboro company plans to raise money through a stock offering

Andi Esposito. Telegram & Gazette. Worcester, Mass. Aug 26, 2003. pg. E.1

Abstract (Article Summary)

&”AMSC’s management and board of directors believe the decision to forgo a secured debt financing and to adopt an equity

financing strategy under current market conditions is in the best interests of our shareholders,&” said Gregory J. Yurek,

chief executive officer of AMSC. The 265-employee company has operations in Westboro and Devens and in Wisconsin.

Finally, the Northeast blackout &”shined a lot of light on the problems we have been talking about as a company for three to

four years,&” Mr. Yurek said. AMSC products, such as a system installed this year in the aging Connecticut grid and high

temperature superconductor power cables and other devices bought by China for its grid, are designed to improve the cost,

efficiency and reliability of systems that generate, deliver and use electric power. &”We are a company with products out

there solving problems today,&” he said.

Assignment Expectations:

The Case report should be a four to five page report (Part I: two to three and Part II: two pages). Please show your work for

Guillermo E. Gonzalez

Module 3: Case Assignment

FIN301 Principles of Finance

17 SEP 2012

Assignment:

Part I

1. For each of the scenarios below, explain whether or not it represents a diversifiable or an undiversifiable risk. Please

consider the issues from the viewpoint of investors. Explain your reasoning

a. There’s a substantial unexpected increase in inflation.

b. There’s a major recession in the U.S.

c. A major lawsuit is filed against one large publicly traded corporation.

2. Use the CAPM to answer the following questions:

a. Find the Expected Rate of Return on the Market Portfolio given that the Expected Rate of Return on Asset &”i&” is 12%, the

Risk-Free Rate is 4%, and the Beta (b) for Asset &”i&” is 1.2.

b. Find the Risk-Free Rate given that the Expected Rate of Return on Asset &”j&” is 9%, the Expected Return on the Market

Portfolio is 10%, and the Beta (b) for Asset &”j&” is 0.8.

c. What do you think the Beta (β) of your portfolio would be if you owned half of all the stocks traded on the major

exchanges? Explain.

3. In one page explain what you think is the main ‘;message’ of the Capital Asset Pricing Model to corporations and what is

the main message of the CAPM to investors?

Part II:

American Superconductor

As you know from reading through the background materials, the decision to use debt or equity to raise money is not a

decision taken lightly by management. So when several years ago, in 2003 American Superconductor decided to raise funds

through equity it was definitely a major decision that required intense discussions at the highest levels of management.

Read the article below about American Superconductor and do some of your own research using the CyberLibrary and internet

search engines. You can also take a look at the official American Superconductor webpage.

After doing your research, apply what you learned from the background materials and write a two to three page paper answering

the following questions:

What are the advantages and disadvantages for AMSC to forgo their debt financing and take on equity financing? Do you agree

with their decision? How can a company’s cost of equity be determined? Is there a tax deduction from the use of debt

financing? Please explain.

Explain both of your answers thoroughly. Be sure to support your opinions on these assignment questions with references to

the background materials or to other articles in your paper.

Read the article below available in Proquest:

American Superconductor switch ; Westboro company plans to raise money through a stock offering

Andi Esposito. Telegram & Gazette. Worcester, Mass. Aug 26, 2003. pg. E.1

Abstract (Article Summary)

&”AMSC’s management and board of directors believe the decision to forgo a secured debt financing and to adopt an equity

financing strategy under current market conditions is in the best interests of our shareholders,&” said Gregory J. Yurek,

chief executive officer of AMSC. The 265-employee company has operations in Westboro and Devens and in Wisconsin.

Finally, the Northeast blackout &”shined a lot of light on the problems we have been talking about as a company for three to

four years,&” Mr. Yurek said. AMSC products, such as a system installed this year in the aging Connecticut grid and high

temperature superconductor power cables and other devices bought by China for its grid, are designed to improve the cost,

efficiency and reliability of systems that generate, deliver and use electric power. &”We are a company with products out

there solving problems today,&” he said.

Assignment Expectations:

The Case report should be a four to five page report (Part I: two to three and Part II: two pages). Please show your work for

quantitative questions.

Grading Rubric: Click here.

BACKGROUND READINGS

Part I

Required Readings:

I personally recommend reading up on the basic concepts behind the Capital Asset Pricing Model first before worrying about

the formula. But still many of you are eager to learn the formulas first, so here are a few links below. But don’t fixate

on the formulas, spend an equal if not greater amount of time reading up on the basic concepts:

Investopedia (n.d.). Capital Asset Pricing Model, retrieved August 2008 from: investopedia.com/terms/c/capm.asp

MoneyChimp, (n.d.) CAPM calculator, retrieved August 2008 from: moneychimp.com/articles/valuation/capm.htm

QFinance, (n.d.) Capital Asset Pricing Model, retrieved June 2012 from:

qfinance.com/asset-management-calculations/capital-asset-pricing-model

Value Based Management, (n.d.) Capital Asset Pricing Model, retrieved August 2008 from:

valuebasedmanagement/methods_capm.html

To gain a deeper understanding of the CAPM and associated concepts beyond just the formula, read:

Damodaran, A. (n.d). Picking the right projects: Investment analysis. Retrieved August 2, 2007 from:

pages.stern.nyu.edu/

adamodar/pdfiles/cfovhds/inv.pdf

Risk and Return (1991). The Economist, 318, 72-73

This Article on Investment Analysis is a highly comprehensive overview on measuring risk and the use of the CAPM. This

article is a good place to start because it will give you an idea of how the CAPM is used in the &”real world&” as well as

demonstrate the basic concepts of this Module.

Optional Readings:

Financial Concepts: Capital Asset Pricing Model. (n.d.). Retrieved August 2, 2007 from

investopedia.com/university/concepts/concepts8.asp

Value Based Management Net, Capital Asset Pricing Model, Retrieved August 1, 2007 from:

valuebasedmanagement/methods_capm.html

Teach Me Finance has a good Page on the CAPM as well as a page on the Security Market Line. These are some brief but

informative tutorials on these important topics.

Here is a good slide presentation on Risk and Return. For an alternative slide presentation, Click Here. No need to go

through both of them, pick one or the other. You will get quite of bit of detail about this topic from these presentations.

If you still want even more information about the CAPM, the meta-sites below will do the trick:

Investopedia.com’s CAPM Overview along with this good Page on the CAPM is worth looking over.

Business.com has a good List of Links on the CAPM (but please ignore the references to the Certified Associate in Project

Management also nicknamed &”CAPM&”)&…

Part II

Required Readings:

Harvey, C. (2002). How do CFOs make capital structure and budgeting decisions. Retrieved August 1, 2007 from:

Journal of Applied Corporate Finance, 15(1), 8-23.

Aswath Damodaran. 1. The Debt-Equity Trade Off: Stern School of Business, Retrieved August 2, 2007 from

Capital Structure Decision.

Optional Readings:

Gotthilf, D. L. (1997). Long-term borrowing techniques. Treasurer’s and Controller’s Desk Book, American Management

Association

This chapter on Finding the Right Financing Mix is good comprehensive resource. You probably don’t need to read the whole

thing, but at least check out the first few pages.

Some of the information below is a bit advanced. Don’t feel the need to read every word, just look through and see what you

find interesting or relevant to this module’s assignments.

This is an excellent Glossary that deal with a wide variety of corporate financial issues.

You are accessing a document from the Department of Energy’s (DOE) SciTech Connect. This site is a product of DOE’s Office of Scientific and Technical Information (OSTI) and is provided as a public service. Visit OSTI to utilize additional information resources in energy science and technology.

A paper copy of this document is also available for sale to the public from the National Technical Information Service, Springfield, VA at ntis.gov.

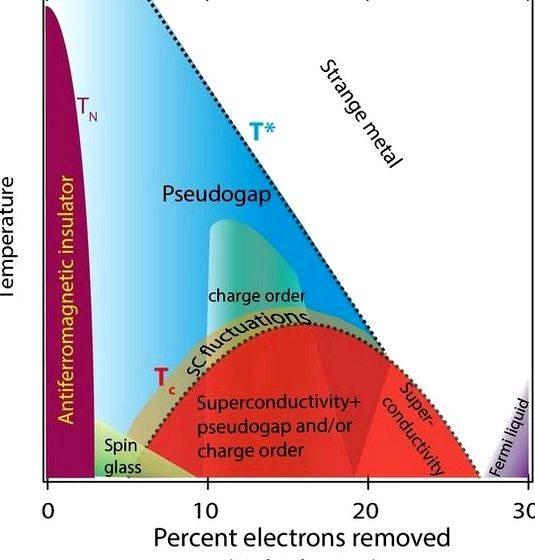

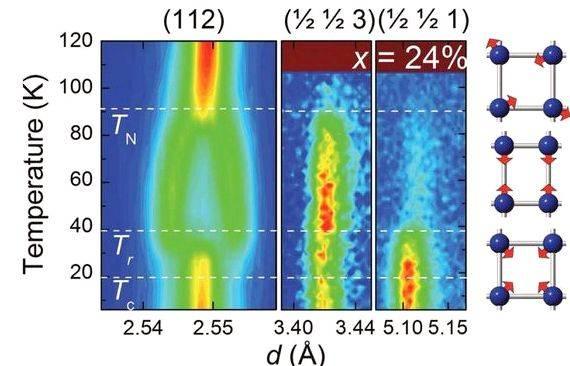

In this dissertation we focus on the investigation of the pairing mechanism in the recently discovered high-temperature superconductor, iron pnictides. Due to the proximity to magnetic instability of the system, we considered short-range spin fluctuations as the major mediating source to induce superconductivity. Our calculation supports the magnetic fluctuations as a strong candidate that drives Cooper-pair formation in this material. We find the corresponding order parameter to be of the so-called ss-wave type and show its evolution with temperature as well as the capability of supporting high transition temperature up to several tens of Kelvin. On the other hand, our itinerant model calculation shows pronounced spin correlation at the observed antiferromagnetic ordering wave vector, indicating the underlying electronic structure in favor of antiferromagnetic state. Therefore, the electronic degrees of freedom could participate both in the magnetic and in the superconducting properties. Our work shows that the interplay between magnetism and superconductivity plays an important role to the understanding of the rich physics in this material. The magnetic-excitation spectrum carries important information on the nature of magnetism and the characteristics of superconductivity. We analyze the spin excitation spectrum in the normal and superconducting states of iron pnictides in the magnetic scenario.more As a consequence of the sign-reversed gap structure obtained in the above, a spin resonance mode appears below the superconducting transition temperature. The calculated resonance energy, scaled with the gap magnitude and the magnetic correlation length, agrees well with the inelastic neutron scattering (INS) measurements. More interestingly, we find a common feature of those short-range spin fluctuations that are capable of inducing a fully gapped ss state is the momentum anisotropy with elongated span along the direction transverse to the antiferromagnetic momentum transfer. This calculated intrinsic anisotropy exists both in the normal and in the superconducting state, which naturally explains the elliptically shaped magnetic responses observed in INS experiments. Our detailed calculation further shows that the magnetic resonance mode exhibits an upward dispersion-relation pattern but anisotropic along the transverse and longitudinal directions. We also perform a qualitative analysis on the relationship between the anisotropic momentum structure of the magnetic fluctuations and the stability of superconducting phase by intraorbital but interband pair scattering to show the consistency of the magnetic mechanism for superconductivity. As discussed for cuprates, an important identification of the mediating boson is from the fermionic spectrum. We study the spectral function in the normal and superconducting state. Not only do we extract the gap magnitude on the electron- and hole-pockets to show the momentum structure of the gap, but also find a peak-dip-hump feature in the electron spectrum, which reflects the feedback from the spin excitations on fermions. This serves as an interpretation of the kink structure observed in ARPES measurements. less

- Iowa State Univ. Ames, IA (United States)

Publication Date: 2011-01-01 OSTI Identifier: 1029610 Report Number(s): IS–T 3026

TRN: US1200033 DOE Contract Number: AC02-07CH11358 Resource Type: Thesis/Dissertation Research Org: Ames Laboratory (AMES), Ames, IA (United States) Sponsoring Org: USDOE Office of Science (SC) Country of Publication: United States Language: English Subject: 72 PHYSICS OF ELEMENTARY PARTICLES AND FIELDS ; 75 CONDENSED MATTER PHYSICS, SUPERCONDUCTIVITY AND SUPERFLUIDITY ; ANISOTROPY ; COOPER PAIRS ; CUPRATES ; DEGREES OF FREEDOM ; ELECTRONIC STRUCTURE ; ELECTRONS ; EXCITATION ; FERMIONS ; FLUCTUATIONS ; IRON ; MAGNETIC RESONANCE ; MAGNETISM ; MOMENTUM TRANSFER ; NEUTRONS ; ORDER PARAMETERS ; PNICTIDES ; RESONANCE ; SCATTERING ; SPECTRAL FUNCTIONS ; SPIN ; SUPERCONDUCTIVITY ; HIGH-TC SUPERCONDUCTORS ; TRANSITION TEMPERATURE

Writing a good abstract for thesis

Writing a good abstract for thesis Writing your thesis in one month

Writing your thesis in one month Thesis writing 1 syllabus plural

Thesis writing 1 syllabus plural Dynamical mean field theory thesis writing

Dynamical mean field theory thesis writing Writing a thesis for an argumentative essay

Writing a thesis for an argumentative essay