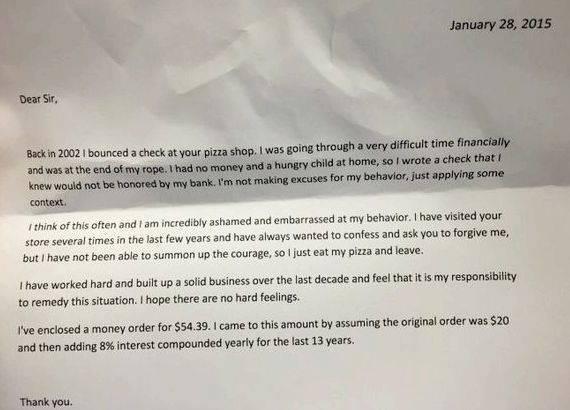

Most check authors don’t plan to write bad checks, but everybody makes mistakes every so often. While it’s nice to consider that receiving full payment for just about any poor check is actually by calling the check author, one phone call might not resolve every incident. Learning to collect profit unhealthy check when to escalate collection efforts can help you confidently handle this uncomfortable and somewhat embarrassing task.

Steps Edit

Part 1 of three:

Receiving full payment for just about any poor Check Edit

Contact the check author directly each time a cheque is came back to suit your needs. Some large companies run bad checks back while using bank again, you probably should not incur multiple bank charges for the same see if you’re a small enterprise operator or possibly person or organization who’s the person obtaining a poor check. Contact the individual on the telephone and follow-up through getting an e-mail for people who’ve their address.

Can you really please put wikiHow across the whitelist for your ad blocker? wikiHow is determined by ad money to provide our free how-to guides. Find out how .

Keep track as soon as and date you contact the check author. Should you contact the check author, leave her with / him a deadline to solve the issue, usually a few days. Ask the individual to call you when the deadline is not convenient and to make promises to solve the problem. When the check author doesn’t respond inside the deadline, send him instructions via certified mail that you’ll be contacting his local police department, since writing bad checks is called thievery. [1]

- If you do not take notice of the check author carrying out a first or perhaps second contact, ask your attorney to draft a much more formal letter and have it delivered via certified mail. [2]

- Only accept profit unhealthy check author to pay for the check together with your came back check fee so you don’t have to be worried about more bank charges in situation your check bounces again otherwise you manage a charge card.

Sign up for a check mark recovery service. They’ll handle collections on bad checks to meet your requirements. Their charges undoubtedly are a legitimate business expense and they also make hassle and embarrassment of coping with bad check authors from your hands. You can setup these facilities so bad checks change from your bank for that check recovery service. They’ll then begin electronic selection of unhealthy check and supply back research.

- You normally get 100 % within the check value and can get rebates that will assist you cover your bank charges, based on your hire the service.

- Check recovery providers include Global Check Recovery, Fiserv, and check Recovery Systems.

Know your state’s laws and regulations and rules and rules handling the writing of bad checks. Every condition differs, getting a few classifying writing bad checks as being a civil offense even though some in a few days it an offence. For individuals who’ve made every effort to call the check author personally and ultizing a collector but have seen no luck, you’ll eventually require for the courts that will assist you collect across the bad check.

Sue in small claims court.

When the balance reaches certain sum of money as based on your condition, you can make situation having a small claims court. You needn’t make use of a lawyer for small claims court, but ensure to produce all documentation regarding the bad check together with your written efforts to gather. [3]

- Small claims court limits vary from $2,500 in Kentucky to $25,000 in Tennessee, while using the usual amount around $5,000. [4]

- The outcome in the suit within the check author may ultimately depend round the court’s decision across the intent within the check. Legal court will settle once the check author simply created a mistake (he thought he’d the cash remaining together with you developing a mistake in calculations) or was planning to disadvantage you, which should be provable by past bad check writing. Check by fraud is really a more severe charge along with the check author could finish imprisonment or prison, according to the harshness of the cost.

- In a number of states you are able to recuperate not just the quantity of the check but in addition triple damages within the check, court costs, interest, bank charges and attorney’s charges in case you used one. It might be helpful to suggest for that check author the $90 bounced check could potentially cause owing over $1,000. [5]

Use a lawyer. When the balance is completed the limit for small claims court, you will need to use a lawyer and have your conditions introduced to the court arrest. Criminal cases may be pricey in case you come down that path. Consider prosecution only when the offender could be a persistent 1 inch your business or amount of unhealthy check is substantial.

Make your own writing worksheets

Make your own writing worksheets Writing about my own character

Writing about my own character Du lich canada tu my writing

Du lich canada tu my writing Writing your life philosophy speech

Writing your life philosophy speech Slam myers walter dean summary writing

Slam myers walter dean summary writing