In December, the brand-new You can Occasions ran a free account about Goldman plus a handful of collateralized debt obligations they underwrote. Calculates the CDOs, that have been built by pooling together other bonds, performed badly. Really, really badly. The thrust within the Occasions piece was that Goldman routinely produced CDOs while using the worst mortgage bonds it might find, then bet against them. Goldman plus a number of hedge funds pocketed billions once the CDOs unsuccessful, while Goldman’s clients who bought the CDOs suffered huge losses. Goldman, clearly, has denied all this.

Number of think Blankfein Co. are innocent, however a think which get lots of attention recently due to Michael Lewis’ new book The Large Short offers some fodder for Goldman’s side within the story. Here’s why:

Lewis’ book is about those who saw the housing bubble along with the economic crisis extended before almost all Wall Street recognized their profit machine involved to blow. Read Barbara Kiviat’s review here. Within the acknowledgments within the book, Lewis praises research printed by Anna Katherine Barnett-Hart because the best research session written on CDOs, ever. At the moment you might have seen the WSJ story about her. Calculates she isn’t some high-compensated hedge fund analyst, but during writting the report a university senior just attempting to earn her degree. Her thesis examines why plenty of CDOs performed worse than expected.

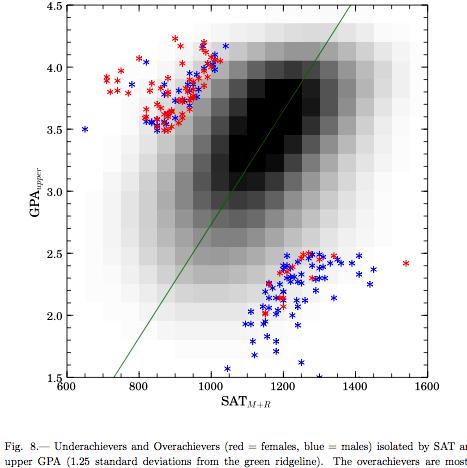

One factor Barnett-Hart examines occurs when the CDOs of several investment banks performed. Calculates Goldman wasn’t the worst CDO underwriter inside the finish.

Quite contrary. Barnett-Hart examined CDO deals underwritten by investment banks from 2002 to 2007, determined that from about 700, Goldman’s CDOs performed much better than almost every other major underwriter within the investment product constantly. While using finish of 2008, just 10% within the bonds that Goldman packed into its CDOs opt bad. J.P. Morgan’s rate of default involved four occasions that, which makes it the worst US investment bank within the CDO game. But lots of others had similarly bad figures. Merrill and Bear demonstrated up in the default rate of roughly 35%, and Citigroup printed a likewise depressing 30%. Barnett-Hart procedes praise Goldman’s CDO underwriting prowess. Here’s what she states:

While using rankings within the.1, we’re able to condition the CDOs of Goldman Sachs consistently outperformed, and they are connected getting a loss of profits of 6% in arrears after controlling for CDO asset and liability characteristics. One of the consistent underperformers are Morgan Stanley, Merrill Lynch, Deutsche Bank, and JP Morgan – JP Morgan’s CDOs are connected getting a fantastic 18% rise in Default typically, after controlling for CDO asset and liability characteristics.

If Goldman was attempting to make the worst performing CDOs, they clearly unsuccessful.

I ran all of this by Goldman critic Jesse Tavakoli and her response may be the efficiency of Goldman’s CDOs hides view of these products these were doing.

Goldman was good at structuring CDOs, and so that you can short industry they didn’t need a ton of deals to visit bad. They simply needed a couple of well place bombs, hidden among the remainder of their excellent deals. If you had individuals clunkers in position, you can buy just as much credit default swap insurance on any single deal whenever you wanted. Along with the insurers like AIG would certainly offer you a good rate, realizing that 95% in the CDOs were performing excellent. They didn’t know you produce a couple of to fail.

The issue with Tavakoli’s scenario is the fact AIG while some would sure be soon capture on. If Goldman requested for CDS contracts on only a couple of particular deals, deals they’d setup, even AIG might have eventually requested what’s did Goldman understood they weren’t telling. And then we know inside the Madden Lane facilities that Goldman was indeed buying insurance on numerous CDOs and bond deals, not only a few.

Another more plausible explaination within the low default rate by Goldman is they weren’t alone. J.P. Morgan includes a large CDS business, it is therefore achievable that banks was doing exactly the same factor. However that doesn’t explain Bear, Citi and Merrill’s poor underwriting record. There’s no evidence individuals banks were searching to complete not go extended mortgage bonds along with the resulting CDOs.

Can this mean we must re-think the entire Vampire Squid factor? Possibly. However a couple of caveats before I am going. Situation study increases to 2008. It’s possible these figures altered dramatically last year, which Goldman’s deals are actually fairing much worse in comparison with other investment banks, though I am unsure why that may be. Second (that we really don’t buy as being a need to not believe the report, but putting it there since i have have know some Goldman conspiracy theorists will uncover it anyway) Anna Katherine Barnett-Hart just lately demonstrated up employment with, you realize who, the Vampire Squid itself. She’ll be beginning there shortly. But Barnett-Hart finished the her thesis nearly yearly before she’d an offer from Goldman. Really, the financial institution she was thinking about prone to in individuals days and work briefly for was Morgan Stanley, which bank doesn’t appear to acquire any special therapy within the report. Lastly, I haven’t had the opportunity to interact with Barnett-Hart to make certain that i’m studying her charts properly. Ann Rutledge at RR Talking with believes the chart on defaults is because of the underwriters within the collateral, not the underwriters within the CDOs. Which will make an impact. However am 99% i am right and Rutledge, despite being very smart and thanked particularly within the Barnett-Hart’s thesis, is wrong. So have a look yourself and choose that you simply affiliate with, and then we all can finally solve permanently if Goldman is often the primary of evil, start our approach to existence and revel in somewhat spring weather.

Subscribe Well-preferred among Subscribers

Guide to writing a thesis outline

Guide to writing a thesis outline Pasasalamat sa isang thesis writing

Pasasalamat sa isang thesis writing Paraan ng pananaliksik sa thesis proposal

Paraan ng pananaliksik sa thesis proposal All optical switching thesis writing

All optical switching thesis writing Performing arts center thesis writing

Performing arts center thesis writing