Within the new underwriting paradigm, the differentiators are individuals who’re pushing challenging the data they need to the underwriting process.

Big data and analytics would be the sentinel change agents within an insurance atmosphere that’s being influenced by radical shifts in terms underwriters assess risk and just how consumers buy insurance. Actually, the mixture of these two is precipitating a large transfer of the standard underwriting role, while leveling the competitive arena.

The systematic integration of those emerging variables is enabling insurers to deal with the next challenges:

1. Manage the gathering of information

2. Integrate data insights in to the underwriting process

3. Utilize data they are driving innovation within the underwriting process

4. Fund underwriting enhancements

Previously, we’d listen to insurers who’d question the worth return from big data. However, the solutions have become more apparent and we’re looking forward to the implications.

A brand new IBM study reports that the continuously growing quantity of organizations – greater than two-thirds – across all sectors are utilising big data and analytics to aid revenue-generation strategies. We’re observing leading insurance companies who’re integrating data inside their underwriting operations – utilizing it they are driving enhancements in sales, marketing, underwriting precision and also to leverage more in the claim adjustment process.

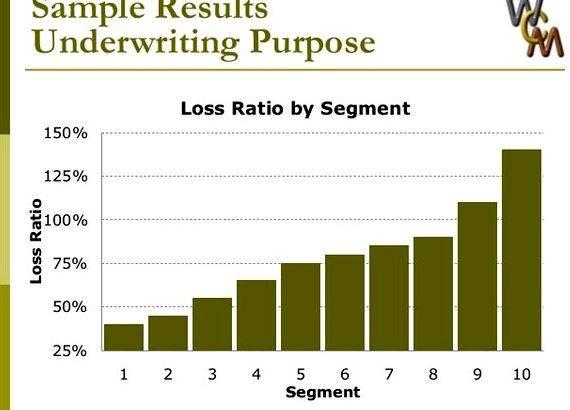

One carrier is profiling submissions after which applying business rules that advice the underwriter on prioritization through ‘fit to appetite’, chance for achievement (predicted hit ratio), and contribution to enterprise growth objectives.

Another carrier is applying cms and analytics to push types of effective deals towards the underwriter (match to current submission) therefore growing the consistency of the quotes and optimizing the hit ratio. Around the claims side, there has been that trends in claim activity tend to be more rapidly recognized, that are then open to push as ‘informational alerts’ to underwriters once the risk they’re focusing on might be similar.

Carriers will also be delivering insights produced from their data to enhance operational performance in different ways, too. For instance, underwriters are supplied real-time personal metrics, advised of key sales points for making proposals, and given the opportunity to incorporate predictive risk scores to balance the danger profile of the book.

Probably the most compelling causes of obtaining the data in to the hands from the underwriter originates from delivering greater consistency within the prices. Having a more precise and predicatively priced model the underwriter includes a tool to determine whereby the plethora of prices a danger resides. They are able to figure out how this affects the profile from the overall book and therefore are better outfitted to understand the “walk-away” or “get aggressive” cost points.

Delivering data insight because it is needed can also be developing a solution for individuals companies who’re less familiar with particular lines of economic. Data and analytics incorporates risk profiling to know the present submission then applies enterprise insight around the connected risks, and may push that understanding towards the underwriter.

Furthermore, the carrier has the capacity to identify available expertise within the organization (for consult online), provide expert underwriting guidance through smart interrogatories, and use of types of sustainable solutions (best practice underwriting from similar risk examples).

We’re also observing tools that may offer real-time cost trends, micro segmentation, exposure concentrations, reinsurance alternatives and predictive alerts. The delicate underwriter is finding out how to funnel this new “guidance”, not in an effort to avoid risk, but because a way to craft lucrative solutions. Further, the intellectual capital developed through the years through traditional underwriting methods has been “found” so that the empirical experience with the expert underwriter isn’t lost within the new underwriting model.

We identified common challenges that insurers coping with regards to integrating data using the underwriting process. Some insurers are combating these challenges using the creative approaches described above, even though many other medication is still battling using their strategy and the way to integrate the data inside their process.

One factor is obvious: Within the new underwriting paradigm, the differentiators are individuals who’re pushing challenging the data they need to the underwriting process and tactical use of their operational execution. In this manner, they’re starting to supply the necessary investment return.

Concerning the authors. John C. Anderson and Carl Sherzer are Senior Management Consultants in IBM Global Business Services’ Insurance Strategy and Transformation Practice. They may be arrived at at jcanderson@us.ibm.com and carl.sherzer@us.ibm.com

Thesis writing service singapore time

Thesis writing service singapore time Julie pitta writing and editing services

Julie pitta writing and editing services Top 10 cv writing services uk

Top 10 cv writing services uk Dissertation service public et union europeenne capitales

Dissertation service public et union europeenne capitales Cv writing services uk reviews for panasonic kxt

Cv writing services uk reviews for panasonic kxt