The Indian Rupee has depreciated with a record low based on the US Dollar. On 28th August 2013, the Indian rupee opt lower to 68.825 within the Dollar nonetheless the problem was somewhat elevated using the Reserve Bank asia that decided to begin a distinctive window so that you can condition owned oil companies – Indian Oil Corp Limited. Bharat Oil Corp and Hindustan Oil Corp.

The beneficiaries can buy dollars through this window till further notice is supplied. These businesses, together, require 8.5 billion dollars each month to import oil that’s expected this permits them to match the needs. It’s had an instantaneous effect because they are apparent in the fact the INR has began at 67 within the USD at the begining of proceedings within the Interbank Forex market. The issue, however, is the reason why this is often happening. Many reasons exist for which can be enumerated in this particular scenario:

Fundamental law of financial aspects

As mentioned through the rudimentary laws and regulations and rules and rules of financial aspects when the fascination with USD in India exceeds its supply then it’s worth increases which within the INR will come lower for that reason. It might be that importers would be the major entities who’re needed the dollar to produce their obligations. Another possibility here could be the Foreign Institutional Investors are withdrawing their investments within the united states . states and taking them elsewhere.

This can produce a shortfall in way of getting the dollar in India. Really, recently, the FIIs are really prone to greener pastures like Singapore because of the greater operational efficiency and lesser bureaucratic issues that have unsettled the Indian business fraternity and hampered its overall economic growth.

This case could only be addressed by exporters that can generate dollars within the system. If for some reason the FIIs may be wooed back, this imbalance may also be addressed to some extent.

Cost of oil

The requirement for oil can be a major bane for India since it must generate just about all its requirement from outdoors the nation. The attention in oil in India remains rising each year which has introduced to the current situation. All over the world, the cost of oil is supplied in dollars. What this means is whenever the attention in oil increases in India or there is a increase in oil prices within the global market, there also arises any excuses for additional dollars to pay for the suppliers. This results in a situation in which the cost in the INR decreases considerably compared to dollar.

Performance of dollar regarding other currencies

The central banks across Japan and countries within the Eurozone are really getting away . lots of money meaning both Yen and Euro have mislaid their value. In comparison to this the united states . states Given is giving hints that it is going to finish the fiscal stimulus and so the dollar will get to become more efficient regarding other currencies like the Indian Rupee no under for the time being. Till now in 2013, the united states . states dollar index is becoming more efficient by 1.91%.

In a interview while using the Economic Occasions, the CO-CIO of Birla SunLife Mutual Fund, Mahesh Patil has noticed that the rise in price of USD may be the responsible for the depreciation within the INR.

The Us Government Reserve’s decision to lessen its Quantitative Easing has in addition contributed to the current situation as every asset class remains affected by the choice.

Volatility within the equity market

The equity markets in India are really volatile for almost any certain time period. It’s place the FIIs in a dilemma whether they should be purchasing India otherwise. In recent occasions their investments have touched an unparalleled level and for that reason after they remove your inflow goes lower too.

According to research operating a company Today, the planet investors in India have withdrawn for that tune of INR 44,162 crore during June 2013 that’s an increasing amount. It is also produced a present account deficit (CAD) calculating only growing, thus adding considerably for that depreciation within the INR.

Connection between equity market problems on investors

Once the INR becomes weak it’ll personalize the investors who’re putting their in India. The very first time since 2012 the FIIs are really reduced to internet sellers of debt based securities. The accountable for this is actually current symptom in the INR. The price incurred in hedging the unpredictable INR are reducing the yield differential this is actually the primary part of profit of individuals investors.

India, really, isn’t the main emerging market in which the currency has received effective. Situations are similar in countries like Indonesia, Latin america and Thailand. The writing markets in lots of countries like India can also be going for a hit because the FIIs are withdrawing en masse. The eft’s can also be being redeemed because the global business fraternity is searching to lessen lower on risks.

Poor current account deficit

One of the greatest reasons for the Indian government’s inabiility to arrest november the nation’s currency may be the critical current account deficit. Within the 2012-13 fiscal India’s CAD was measured at 4.8 percent within the GDP. The federal government remains not able to create any new destinations for conveying its products which has in addition hampered the development during this sector. There are more crucial reasons here like getting less one window for clearance purposes and procedural delays. Even locations where India has typically been effective concerning this front have fared badly now.

Withdrawal of investors

Lately ArcelorMittal and Posco decided to tug utilizing their projects in India. Posco didn’t proceed obtaining a steel plant worth INR 30,000 crore which was mentioned to get built-in Karnataka and ArcelorMittal withdrew from developing a steel plant in Odisha which should cost around 52,000 crore. There’s been lot of delays and problems associated with obtaining land for the project. Really this year-13 the Indian companies have spent more outdoors India in comparison to FIIs in India.

Downgrading of Indian stocks

Goldman Sachs, one of the primary banks on the planet, has rated Indian stocks to get underweight. It’s also requested investors to obtain careful because of the concerns all around the recovery from the development of Indian economy.

Condition of import bill

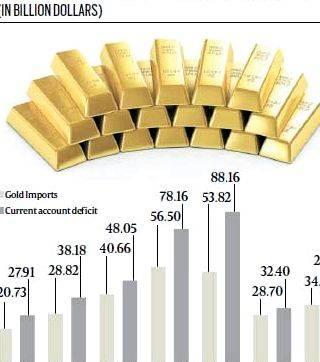

India’s import bill remains rising recently and a lot of from the is often connected with gold. It is also hampered India’s efforts to arrest the slide within the INR. Gold alone occupies greater than ten percent of India’s import bill – in April 2013, 141 plenty of gold were imported and it also elevated to 162 during May. The federal government needed some measures that restricted gold imports to 31 tons during June however, if again within the first 25 days in this particular summer time time the imports elevated to 45 tons.

Contraction of Indian economy

The different important sectors of Indian economy for example manufacturing, mining and agriculture have seen poor increase in 2013 making them less appealing propositions for the investors. During June 2013, the aggregate industrial production in India reduced by 2.2 percent plus This summer time time 2013 the RBI predicted that inside our fiscal you will notice a noticable difference of 5.5% that was lesser than its previous conjecture of 5.7%.

Potential customers of INR

Regardless of all that has been pointed out above it will be foolish to create within the INR completely and express it shall not rise in the mire. Experts the federal government should have a few short and medium term steps that can help the economy return to its feet once more. It is just through ongoing efforts the Indian government can retrieve the problem. However, it should take a Herculean effort to assist the INR return to the 55 mark.

Excellent article…I can condition this publish is a superb resource!!

In truth I live in America and have never visited India but hold that country near to me. To more cost-effective situation there though, Indians have to get rid of the undercover community, stop buying imported goods particularly imported electronics (cellphones, computers, tv’s) and imported cars. Take into consideration Indians have to do is invest money in their own individual personal stock exchange and purchase bonds for Indian companies. This step, I’m capable of promise works. Only reason china Yen isn’t bigger when compared with dollar is they like Indians import many articles of yank fashion and they also buy electronic goods from Japan and S. Korea once they like Indians might be buying their unique goods to greater their economy.

Excellent article, after i begin to see the article and comments below, some generate earnings believe that everybody is really accountable for this lower fall. My day itself begins with a Colgate, well, i’m just believing that we’re a good deal according to foreign products. I’ve decided to avoid this now or it will be never, might also try and share this data with my pals and relatives. Appreciate writing this sort of nice article. Keep writing Samudranil. )

for me The Data WAS GREAT….

I’m Students Of Sophistication X..i increased to get of see ur article….for me its v nice. together with things i fell may be the comments below from various people and ur replies become more effective….i m writing by having an interschool competition…and individuals comments have taught me to be a great deal…ur article too…thanks a great deal…keep writing and discussing ur enormous ideas around

Thanks Yatin. However, I’m not a real prodigy whenever you mentioned. Now i am a author who did some analysis and who’s happy that his work remains of some utility having a student.

Am naresh from proddatur ,I going after Master of business administration course,give thanks to you for information, nowadays more countries not rely on any country nd any company to production all just about all everything but India was import these items nd rely on some countries ,y becouse I don’t know ,nd some causes for depreciate rupee value.

I’m poor in immediate and ongoing expenses nonetheless it had been nice to uncover your article after i chosen over understand cause behind deprecation. Are you able to also believe we’re getting globalised whilst not using localised products? We’re getting dependent increasingly more much more about other country products. You believe if everybody create a small difference in our lifestyle it might help?

Whenever you can focus a little more about local products then clearly it will also help the economy a great deal however people prefer worldwide products a good deal that it takes the time to adjust. I’m also honored that you simply loved my article

excellent article… very detailed n covered all facets…. n useful personally so thanks mister.

Initially we must use indian products and also have to consider concern yourself with for you to get product of other country just quit taking use less factor business country indian government need to new company increase the risk for goods that have been needed as well as conserve the people by offering jobs also and presently have plenty of raa materials every were it can benefit for transforts also

Yes, you’re correct. The introduction of domestic industries must be important now. Worldwide brands, however, shouldn’t be totally disqualified. An equilibrium ought to be struck the next.

For me government should start business representatives and elaborate investment options, to relieve on FII’s.

Provided details are are frequently sweet and straightforward, whilst not so elaborate.

Yes, it might be a good idea to see what steps they are intending to reviving the nation’s economy.

can you really you need say the way a rupee value can get low due to obtaining the foreign products..

What’s the impact % on rupee value once we buy Indian goods(grocerry products atleast) instead of

foreign products

See foreign products need to be bought in dollars then when we keep buying such products this means our dollar reserve will most likely be exhausted. This can produce a situation in which the way of getting dollar will most likely be under its demand. This, consequently, shall reduce the cost in the INR based on the dollar.

It may be so but may you kindly elucidate within your point?

With different publish WW2 conference, the united states . states made an arms cope with OPEC countries like Saudi Arabia while some to possess oil payments to produce only in dollars. Couple of other currency payments are allowable.

China and Russia possess a separate pact. India’s sticking with the same pact with Iran right now. Whether it calculates, it might help bring the present account deficit lower..

USA’s invasion of Afghanistan, Iran. Prohibition sanctions on Israel, Venezuela. All’s been for the oil.

Essentially exactly the same reason the united states . states’s after Syria right now. The so known as “Chemical weapons issue.”

Simple logic- Oil prices rise, $ value increases. Oil prices hit affordable, USA’s economy hyperinflates along with the entire country comes lower like a house of cards.

India has sufficient coal reserves. Rather out of this our country is importing coal. Why. For the reason that in our internal problems. We don`t have creamy layer within our country. These opt abroad because others r getting to cover them more. Which means that we’re lagging behind in technology

When you’re from kolkata Samudranilda, you will need to create and discuss the coupan system in bus. It truly is a important issue.

It had been a great analysis. Areas affecting november Rupee are covered quite substantially. It provides an exciting-natural picture.

However details and figures are restricted to period nearing April-This summer time time 2013. Personally, previous or average figures can provide a apparent picture.

Plus future possible steps to enhance the rupee, might have been given.

Escape INR unless of course obviously clearly you need to loose your shirt completely, individuals have finally recognized that India is, was but nevertheless could be a complete waste. The politicians asia haven’t an idea on the way to run India, it’s about time for India to simply accept its failures .

India is not pointless…. u r absolutely ryt abt d politicians nevertheless its bcoz people our currency is dwindling…..if u believe that india is really a complete waste of tym rather u must ruminate that citizens r too..citizens buy foreign items that provide u nthng greater than fancy…..buy indian products and c d the main difference it will make for the economy……BUY INDIAN PRODUCTS IF U WANT INDIA To Not BE Pointless.

My sincere because of everyone for writing such thauthful articles / posts. I’m inadequate in immediate and ongoing expenses, however coule able to understood the true reason for Rupee depraciation. Also understood freom above posts that, we must avoid buying foreign product incourage Indian ones. I truly desire to understand one ingredient that, the whites we’re inviting foreign investors to India, offering them good facilities so they will need their plants in India. So obveously, they’ll start producting their brands selling in India. Now, once we stop buying foreign product, they’ll discountinue production in India beeps. You need to’ll say Investors Are coming back hence Rupee is depriciating. I truly desire to realise why statistic, Can somebody allow me to to explain.

Register to MyIndia

Article 6 cedh dissertation proposal

Article 6 cedh dissertation proposal Web of science missing articles in writing

Web of science missing articles in writing Writing a newspaper article ks3 maths

Writing a newspaper article ks3 maths Writing journal articles requirements for medicaid

Writing journal articles requirements for medicaid Article writing on save environment photos

Article writing on save environment photos